- I have before me the application by Alvina Collardeau-Fuchs for maintenance pending suit made on 13 September 2021.

- I will refer to the applicant as “the wife” and to the respondent as “the husband”.

The background facts

- The husband is 62 and the wife is 46. The husband holds German and US citizenship (having moved to the US from Germany in the 1990s). He has enjoyed an extremely successful career as a property entrepreneur. The wife holds French citizenship. She was a journalist but has not worked since the early days of the relationship.

- The parties began cohabiting in 2008 (according to the wife) or in 2010 (according to the husband). Nothing turns on this disagreement for the purposes of this application. They were married on 14 April 2012. They separated in March 2020. The wife’s divorce petition was issued on 22 December 2020. Decree Nisi was granted on 24 August 2021 but has not yet been made Absolute.

- Although this litigation is at a relatively early stage, the parties have nonetheless incurred considerable costs. The Forms H filed and served in advance of this hearing show that the husband has incurred costs of £450,189 and the wife has incurred costs of £467,793, a total of £917,982. They estimate spending a combined total of a further £288,700 to the conclusion of the Private FDR Appointment on 28 March 2022.

- The wife continues to live in the family home in West London (“the West London property”). It is a substantial property. It has six floors, five bedrooms, an indoor underground swimming pool and access to both a private and communal garden. In total, its area is over 700 square metres. The parties historically employed a retinue of staff: two rota chefs, a house manager, two or three housekeepers, and a laundress in addition to contractors (gardeners, pool maintainers, builders, plumbers, electricians, and handymen). The husband asserts that the property is worth £30.2 million and is subject to a mortgage of £21.5 million. When in the UK, the husband lives in a relatively modest apartment owned by the parties which is located near to the West London property.

- There are two children of the family, A who is 6 and B who is 3. They both live with the wife. There are ongoing private law children proceedings in respect of the arrangements for the two children. The detail of those proceedings is not before me. I note, however, that the litigation is hotly contested; I am told substantial sums have been spent on the legal fees in those proceedings.

- Prior to their marriage, the parties executed a pre-nuptial agreement in New York on 2 March 2012 (“the PNA”). Both parties made disclosure of their financial circumstances prior to the execution of the PNA. The husband’s net worth was said to be $1.064 billion and the wife’s was said to be $4.471 million. Both parties had advice from, and were represented by, distinguished lawyers. No suggestion has been made that there was any deficiency or pressure within the process leading up to the execution of the PNA.

- Following their marriage, the parties executed a “Modification Agreement” in New York on 23 March 2014 (“the MA” and, collectively with the PNA, “the Agreements”). The MA increased the financial provision that was made to the wife pursuant to the PNA. As with the PNA, there has been no suggestion that the process leading to the execution of the MA was in any way flawed.

- The husband seeks to hold the wife to the terms of the Agreements. In simple terms, he says that the effect of the Agreements, if implemented, would be to provide the wife with net capital of £23.5 million plus 18 years of rent-free accommodation at the West London property. The husband says that on any objective view this provision meets the wife’s needs. Notwithstanding the terms of the Agreements, the husband accepts that he will need to provide interim financial support to the wife pending the determination of whether or not the Agreements should be upheld.

- It is common ground that during the marriage the parties enjoyed an extremely high standard of living. They had the use of properties around the world (including a property located in the heart of the Cap D’Antibes, to which I will return later in this judgment). The parties employed a significant number of staff at the West London property, as I have described above, and in their other properties. It is agreed that the parties would spend a great deal of time travelling, typically by private plane or first-class commercial flights, and staying in high-end hotels or villas at significant cost.

- Following separation in March 2020, the wife complains that the husband, in effect, almost immediately reduced the provision he was making for her. She claims that, prior to separation, the husband had transferred £10,000 per month to her HSBC account and €20,000 to her Société Générale account (if not more in some months). He stopped making those payments in April 2020 and, upon being invited to reinstate the transfers in June 2020, declined to do so. The wife says that in December 2020 the husband limited expenditure on her American Express card to $20,000 per month (although this was later raised to $25,000 per month). The wife makes various other complaints about the husband’s failure to make payment of other outgoings on time (including payment of staff salaries).

- The husband’s response to the wife’s complaint is that she had been spending at a profligate level and that the time had come to impose some financial discipline. He has said, for example, that the wife spent $273,000 in October 2020 and $185,000 in November 2020 on her American Express card and that that is why he imposed the limit on it. He also denies the allegation made that he has failed to make the payment of various outgoings on time.

The procedural history

- On 30 March 2021, the husband made an application for financial remedies in Form A (“the substantive application”) and an application for the wife to show cause why an order should not be made in the terms of the Agreements (“the show-cause application”). The husband also sought an order that the automatic timetable for the exchange of Forms E and other conventional directions be suspended.

- Those applications were issued on 14 April 2021. I gave directions on paper on 19 April 2021 suspending the substantive application pending determination of the show-cause application; listing the show-cause application for directions before me; and directing the husband to serve a short schedule of his assets to which there was to be appended (i) in tabular form a schedule of the approximate global expenditure of the family for the calendar years 2019 and 2020; and (ii) an approximate calculation of the sum which the wife would receive pursuant to the Agreements.

- The husband duly complied with my directions as to the information he was to provide. He filed and served the following documents (all dated 25 June 2021):

i) A schedule of assets showing properties with a value of £28,128,293, bank accounts holding £25,220,234, investments of £72,311,909, insurance policies of £605,262, monies owed to him of £2,545,599, chattels of £27,763,662, pensions of £30,214, business interests of £1,695,915,726, and liabilities of £606,988,804. The husband’s total net assets were therefore said to be £1,245,532,056.

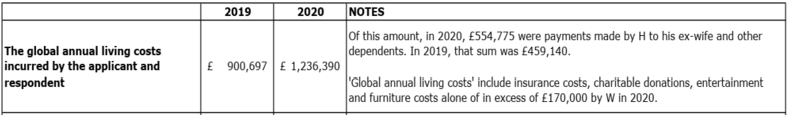

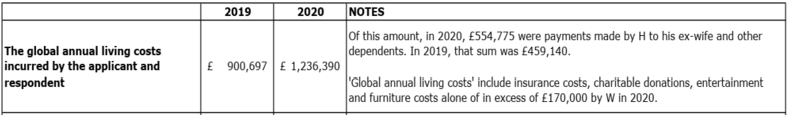

ii) A schedule of living costs for the calendar years 2019 and 2020 showing the following:

|

Item |

2019 |

2020 |

|

Global annual living costs incurred by the parties

|

£900,697

|

£1,236,390

|

|

Running costs of all properties used as a home by the family |

£1,090,772

|

£1,169,803

|

|

Costs of all staff employed by the family |

£1,196,822 |

£1,113,994 |

|

Costs of running the parties' household other than in relation to properties

|

£477,161

|

£497,672

|

|

Costs of travel and holidays

|

£853,288

|

£1,228,669

|

|

All discretionary expenditure of the parties not otherwise addressed above

|

£194,363

|

£680,689

|

|

Other expenditure exclusively incurred in relation to or for the benefit of the children of the family |

£62,661

|

£38,369

|

|

| | |

|

Total per annum |

£4,775,764 |

£5,965,586 |

|

Total per month |

£397,980 |

£497,132 |

iii) A schedule setting out the approximate calculation of the sum which the wife would receive pursuant to the Agreements. That sum totalled £23,500,267.

- The wife made the maintenance pending suit application on 13 September 2021. In the body of the application notice, she explained that she sought the sum of £350,000 per month (which included an element of provision for the needs of the children of the family), on the basis that she would take over responsibility for paying overheads of the various homes including staff salaries. She filed and served a statement in support of the maintenance pending suit application also dated 13 September 2021.

- The husband made an open offer for the overall resolution of the proceedings on 22 September 2021. In terms, it provides for the implementation of the Agreements which would have the net effect as explained above. The husband proposed that there be no order as to costs provided the open offer was accepted within 21 days (which has now long since passed) and thereafter the lump sum payable by the husband was to be reduced by £1 for every £1 spent by him on costs. In circumstances where the husband has thus far incurred costs of £450,189 and anticipates incurring a further £151,500 to the conclusion of the Private FDR Appointment, any such reduction in the lump sum to be paid by the husband to the wife will likely be substantial.

- I conducted a case management hearing on 27 September 2021 at which:

i) I gave further directions as to the evidence to be filed in both the show-cause application and the maintenance pending suit application. I granted express permission to the wife to make an application on short notice for an earlier hearing of the maintenance pending suit application in the event she considered she was entitled to emergency relief in advance of the substantive hearing of the maintenance pending suit application that I listed to be heard on the first open date after 1 November 2021.

ii) I granted the parties permission to instruct a single joint expert in the form of a lawyer suitably qualified in the State of New York to prepare a report on whether the Agreements would be upheld in the court in New York (including in relation to any interim maintenance application). No such report has been obtained by the parties.

iii) I dispensed with the requirement under FPR 9.15(4) that the parties attend an in-court FDR Appointment on the basis that the parties are to attend a Private FDR Appointment before Mr Dyer QC. I understand that that Private FDR Appointment has now been fixed to take place before Mr Dyer QC on 28 March 2022.

iv) Finally, I listed the show-cause application for a Final Hearing with a time estimate of three days. It is fixed to commence on 10 October 2022.

- The wife applied for an earlier hearing of the maintenance pending suit application on 25 October 2021 on the basis that the husband had failed to make payment of outstanding invoices and holiday costs notwithstanding an earlier assurance he would do so. In support of that application, she filed and served her second witness statement dated 23 October 2021. I understand that the wife was ultimately offered 19 January 2022 as the date for the earlier hearing of the maintenance pending suit application, but that she turned this down.

- The husband filed his first witness statement in response to the maintenance pending suit application on 5 November 2021. He proposed that he should pay the wife:

i) A maximum of $25,000 per month being approximately £18,500 per month for her discretionary expenditure.

ii) Her reasonable holiday costs. At the time of this hearing, the husband proposed the fixed sum of £100,000 for the next eight months.

iii) £6,250 per month for child maintenance on the basis that he would continue to meet the school/nursery fees.

- The husband also proposed that he would continue to meet all of the running costs (including staff costs) for the West London property and the other properties directly.

- This remained the husband’s open position at this hearing.

- The wife filed her third witness statement in the show-cause proceedings on 7 December 2021. Her core objection to an order being made in the terms of the Agreements is that, in real terms, it would not permit her to remain living at the West London property until the youngest child of the family attains the age of 21 as she would be unable to fund the cost of living in a property of that scale. As the design of the Agreements was that she be able to do so, she says that it would be unfair for an order to be made giving strict effect to the Agreements.

- The wife exhibited a questionnaire to her third witness statement. No formal application for an order that the husband answer the same has been made by the wife. As I said during the hearing, I consider that the question of whether the husband should be required to answer some or all of the wife’s questionnaire should be adjourned for consideration at the directions hearing that will be listed to take place in the event the Private FDR Appointment does not produce an overall agreement. In my judgment, the husband has provided sufficient information about his financial circumstances for an effective Private FDR Appointment to take place without the need for answers to the wife’s questionnaire.

- The wife made a revised open offer for the resolution of the maintenance pending suit application on 28 January 2022. In broad terms, she proposed that the husband pay:

i) £70,000 per month for her discretionary expenditure.

ii) £60,000 per month for her holiday costs.

iii) £2,935 per month to enable her to meet the costs of the children’s school/nursery fees.

iv) Sums sufficient to meet the costs of the staff at the West London property (on the basis that the husband takes all necessary steps to transfer the contractual employment of the same staff to her).

v) Sums sufficient to pay any invoice as to running costs, utilities, tax, insurance, repair or maintenance or legal costs relating to any of the properties considered “Joint Property” for the purpose of the PNA.

- The wife also proposed that the husband should give various undertakings relating to the other properties and that the husband continue to meet her legal costs.

The matters no longer in issue

- The wife has complained that the husband has been failing promptly to discharge various costs that he has agreed to meet. That is why in the maintenance pending suit application she has sought to, in effect, take over the responsibility for meeting various outgoings on the basis that the husband continues to pay for the same.

- The husband denies the allegations made and says that any transfer of the responsibility for the management of meeting those various costs is unnecessarily complicated.

- This matter is, however, now no longer in issue, as I shall explain.

- In advance of this hearing the husband’s lawyers circulated a draft order which contained recitals recording the parties’ agreement that until the conclusion of the show-cause application:

i) the husband would continue to meet all of the overheads (to include but not be limited to the running costs, utilities, insurance, repair or maintenance) and staff costs of the West London property directly as they fell due; and

ii) the husband would meet any additional or occasional invoice or bill received by either party (or their staff) relating to (i) the overheads or staff costs of the West London property; (ii) school or nursery fees and extras and any other expenses directly referable to the children; and (iii) the wife’s legal fees within 14 days of the relevant invoice being uploaded to the portal (q.v.).

- On 5 October 2021, the husband had proposed, and the wife had agreed, that a shared access folder (‘the portal’) should be set up. The intention was that the wife was to upload any relevant invoices to the portal. Upon the same being uploaded, the husband would pay the invoice and the same would be marked as having being paid on the portal.

- The wife has complained that that regime has not worked well to date. She has provided numerous instances of what she says are failures of the husband to properly ensure invoices and other costs are paid promptly. The husband, both in his witness statement filed and served in advance of this hearing and through counsel, rejected those allegations. I was not invited to make any findings on these issues and nor would it be appropriate for me to so at this stage of the proceedings.

- However, provided that the husband gave undertakings in the terms of the proposed recitals contained in the draft order then the wife, through counsel, indicated that she would be content to accept them and would no longer pursue her claim for the management of the costs of the West London property being transferred by the husband to her.

- I am content, subject to para 37 below, to approve this agreement and to accept undertakings in those terms; indeed, had the wife not requested them of the husband, I would have required them of him.

- I was informed at the outset of this hearing that the husband, having committed to meet the wife’s legal fees, has not paid them since early December 2021. Some £363,732.39 remains outstanding. That figure reflects her outstanding costs in these proceedings, being £204,513, plus a figure referable to the private law children proceedings.

- This is unacceptable. It is not reasonable for the husband, who has committed to pay the wife’s legal fees and on any view has the means to do so without delay, to expect the wife’s advisors to work without payment for any material period. Those outstanding fees, and any future fees, are to be paid immediately by the husband following uploading of an invoice to the portal, and not within 14 days (see para 31(ii) above).

My decision

- As explained above, the wife’s claim for maintenance pending suit is that, in addition to the payment by the husband of the overheads, he should pay her £130,000 per month (an annual rate of £1.56 million). The husband’s proposal is that he should pay the equivalent of £31,000 per month (an annual rate of £372,000), together with the agreed overheads.

- Those overheads are set out at paragraph 16(ii) above. They are enormous. The 2020 figure for the annual running costs for the running of the London properties, the villa in Antibes and the penthouse in Miami is £1,169,803. The figure for the cost of staff in those properties is £1,113,994, and the husband has calculated that a further sum of household costs of £497,672 is payable giving a total amount for these overheads of £2,781,469. When added to the wife’s spending claim of £1.56 million it can be seen that she is asking the court to endorse a rate of interim expenditure of £4,341,469 per annum.

- In F v F (Ancillary Relief: Substantial Assets) [1996] 2 F.C.R. 397 Thorpe J memorably stated in a case where the husband was (by the standards of 1996) vastly rich:

“The fact is that the Matrimonial Causes Act 1973 is a statute designed to provide statutory criteria sufficiently flexible to meet the circumstances of every conceivable case. The reality is that the husband and wife in this case belong to a tiny percentage of the world population who have control and management and entitlement to huge sums of money. The husband in his substantive affidavit in the proceedings has said that for their purposes he is willing that the court should treat him as having now and in the foreseeable future capital assets of not less than £150m. The wife says, although it is in issue, that in marriage he told her that their annual expenditure amounted to £4m.

Thus, in determining the wife's reasonable needs on an interim basis it is important as a matter of principle that the court should endeavour to determine reasonableness according to the standards of the ultra rich and to avoid the risk of confining them by the application of scales that would seem generous to ordinary people. Thus I conclude that it would be wrong in principle to determine the application on some broad conclusion that if the wife cannot manage at the rate of a quarter of a million a year, she ought to be able to. I think that it is necessary to establish a yardstick that more nearly reflects the standard of living which has been the norm for the wife ever since marriage and for the husband for considerably longer.”

- It may well be that Thorpe J, when warning against the application of middle-class, middle-income values to such a case, was consciously or subconsciously recalling the legendary, but almost certainly confected, remark by F. Scott Fitzgerald to Ernest Hemingway that “the rich are different from you and me” (to which Hemingway allegedly replied “Yes, they have more money.”)

- The principles to be applied on an application for maintenance pending suit were summarised by me in TL v ML and Others (Ancillary Relief: Claim against Assets of Extended Family) [2006] 1 FLR 1263 at [124] as follows:

“From these cases I derive the following principles:

(i) The sole criterion to be applied in determining the application is 'reasonableness' (s.22 of the Matrimonial Causes Act 1973), which, to my mind, is synonymous with 'fairness'.

(ii) A very important factor in determining fairness is the marital standard of living (F v F). This is not to say that the exercise is merely to replicate that standard (M v M).

(iii) In every maintenance pending suit application there should be a specific maintenance pending suit budget which excludes capital or long-term expenditure, more aptly to be considered on a final hearing (F v F). That budget should be examined critically in every case to exclude forensic exaggeration (F v F).

(iv) Where the affidavit or Form E disclosure by the payer is obviously deficient, the court should not hesitate to make robust assumptions about his ability to pay. The court is not confined to the mere say-so of the payer as to the extent of his income or resources (G v G, M v M). In such a situation, the court should err in favour of the payee. …”

- In the recent decision of Rattan v Kuwad [2021] EWCA Civ 1 at [38] Moylan LJ accepted the “general effect” of these principles. But he added:

“…as with all guidance, they clearly have to be applied in the particular circumstances of the individual case. In the present case, for example, it was not necessary for the wife to provide a specific maintenance pending suit budget. Her income needs as set out in her Form E matched her needs for the purposes of her application for maintenance pending suit. Further, not all budgets require critical analysis. The extent to which a budget or other relevant factors require careful analysis will depend on the circumstances of the case. I return to this below but, in summary, the wife's budget in this case did not require any particular critical analysis; it was a straightforward list of income needs which were easily appraised.”

- Moylan LJ went on at [39] to cite his decision in BD v FD (Maintenance Pending Suit) [2016] 1 FLR 390 at [34] where he in turn cited his decision in G v G (Child Maintenance: Interim Costs Provision) [2009] EWHC 2080 (Fam), [2010] 2 FLR 1264 at [52] in which he stated that an application for maintenance pending suit was:

“… a very broad jurisdiction but it is one which, as I have said, should be exercised when on a broad assessment the court's intervention is manifestly required. Otherwise parties will be encouraged to engage in what can often be an expensive exercise in the course of the substantive proceedings when the proper forum for the determination of those proceedings, if they cannot be resolved earlier by agreement or otherwise, is the final hearing when the evidence can be properly analysed and the parties' respective submissions can be more critically assessed.”

- Earlier, at [34] and [35] Moylan LJ cited two cases which described the court’s approach on a maintenance pending suit application as “rough and ready” viz:

i) F v F (Maintenance Pending Suit) (1983) 4 FLR 382 where Balcombe J stated at 385:

"Clearly there must be an empirical approach, since on an application for maintenance pending suit it is quite impossible practically to go into all the kinds of detail that the court can go into when dealing with the full hearing of an application for financial relief, and in the ordinary sort of case the registrars who deal with these applications will have to take a broad view of means on the one hand and income on the other and come to a rough and ready conclusion."

ii) Moore v Moore [2010] 1 FLR 1413, CA where Coleridge J stated at [22]:

“An order for maintenance pending suit is, as Bodey J observed, ‘a creature different in form and substance from substantive orders made upon the making of decree nisi’. It is designed to deal with short-term cash flow problems, which arise during divorce proceedings. Its calculation is sometimes somewhat rough and ready, as financial information is frequently in short supply at the early stage of the proceedings.”

- In citing these cases I do not believe that Moylan LJ was saying that a claim for maintenance pending suit should not be subjected to the same degree of careful scrutiny as any other interlocutory claim. Sometimes, as here, enormous sums turn on the decision and it seems to me that just as much care should be taken in reaching it as would be applied to a claim, for example, for an injunction or interim damages. In this case, as mentioned above, the parties have in the financial proceedings already run up costs of over £900,000. For the maintenance pending suit application alone the wife has run up costs of £110,000; I assume that at least that amount has been incurred by the husband. The application was made on 13 September 2021; it is not as if it has come before the court in great haste. It therefore seems to me, given the sums at stake, that the court should try to paint its decision with a fine sable rather than a broad brush, where it has the ability to do so. Of course, in most cases the court will not have either the time or the material to conduct an exhaustive investigation and so the exercise will perforce be rough and ready. In this case, it will be seen that the court has not been equipped to conduct the sort of detailed investigation that the costs expended and the time available suggest should have been possible, and so, regrettably, there will be rough and ready aspects to my decision.

- In this case, as explained above in paragraph 15, the husband was ordered by me on 19 April 2021 to give details for 2019 and 2020 of the annual costs of certain specified categories. The husband duly complied with my order, and the figures are set out at paragraph 16(ii) above. The data that he provided for 2020 formed the basis of the wife’s claim as formulated in paragraph 34 of her witness statement dated 13 September 2021 and in her open proposal of 28 January 2022. That proposal seeks £70,000 per month for her personal discretionary spending. It was calculated as follows:

|

Global annual living costs |

1,236,390 | |

|

Payments to dependants |

(554,775) | |

|

681,615 | |

|

Less, say, 40% referable to H alone |

(272,646) | |

|

W's notional living costs |

408,969 |

A |

|

Discretionary expenditure |

680,689 | |

|

Less 40% referable to H alone |

(272,276) | |

|

W's notional discretionary expenditure |

408,413 |

B |

| | |

|

Children |

38,369 |

C |

| | |

|

Total A + B + C |

855,751 | |

|

per month |

71,313 | |

- In addition, the wife seeks £60,000 per month for holidays. This again was justified by reference to the 2020 data supplied by the husband. It was calculated as follows:

|

Travel and holidays |

1,228,669 |

|

Less, say, 40% referable to H alone |

(491,468) |

|

737,201 |

|

per month |

61,433 |

- Rounding down, the wife’s claim for these two items is therefore £70,000 + £60,000 = £130,000 per month.

- Mr Bishop QC roundly condemns this approach as “completely flawed logic”. First, he says that the notes to the data provided by the husband show that the global annual living costs section is almost completely irrelevant to maintenance pending suit, being made up of insurance which the husband will pay directly, charity payments and furniture costs. He asserts that the only element which may have some maintenance pending suit relevance is entertainment.

- Second, Mr Bishop says that it would have been fairer to have taken an average for 2019 and 2020 rather than 2020 alone.

- Third, Mr Bishop says the 40% allocation of expenditure to the husband is illogical and wrong; it should be no lower than 50%.

- Accordingly, Mr Bishop argues on behalf of the husband that the current allowance of $25,000 per month, or £18,500, is entirely reasonable.

- Mr Bishop rejects the holiday claim as being unsophisticated and grossly excessive. He submits that over the next eight months, being the period until the determination of the show-cause application, £100,000 for holidays is entirely reasonable. At least one holiday can be taken during the period in the villa in Antibes, which would incur the wife virtually no cash cost whatsoever.

- The husband’s proposal for holiday money corresponds to a rate of £100,000 ÷ 8 = £12,500 per month.

- Therefore, the husband’s proposal for these two items is the equivalent of £18,500 + £12,500 = £31,000 per month.

- The parties are therefore £99,000 per month apart, an annual rate of £1,188,000. This is a vast amount. The competing claims therefore should be examined with as much care as possible.

- It is a dominant principle in a maintenance pending suit application that the marital standard of living immediately before the breakdown of the marriage is highly relevant, and can, in a minority of cases, be determinative of the application. In the majority of cases it cannot be determinative because of the impossibility of stretching the income which provided the marital standard of living in one home into the provision of that same standard in two homes. But with the very rich this problem does not arise.

- In this case it is clear that the marriage was heading for the rocks at the end of 2019 when the husband began complaining about the wife’s expenditure. The parties separated in March 2020. I have concluded that the data which the court should be examining in order to determine the marital standard of living is that given by the husband for 2019. I am not satisfied that the higher figures for 2020 are representative of the marital standard of living, and it follows, by the same token, that I do not agree that an average of 2019 and 2020 is representative of that standard.

- Surprisingly, neither side sought to undertake a granular analysis of the wife’s expenditure in 2019 for the whole of that year. The husband had, of course, produced the data for 2019 in his response to my 19 April 2021 order. Later, he did undertake some detailed analysis of the wife’s expenditure from October 2019 onwards. The wife, likewise, has analysed her expenditure by reference to her American Express card from October 2019 onwards. But no equivalent analysis was done of the family’s, and specifically the wife’s, expenditure for the whole of the last calendar year of the functioning marriage.

- A major element in the husband’s Schedule of Family Living Costs was the very first entry. This was as follows:

- In paragraph 50 above I have set out Mr Bishop QC’s attack on Mr Cusworth’s use of these figures. Mr Bishop QC contended that the phrase “costs include insurance costs, charitable donations, entertainment and furniture costs” meant that the overall total exclusively comprised these elements, and that of these elements only entertainment was relevant for maintenance pending suit purposes. I have to say that I did not read the phrase that way. The use of the verb “include” clearly suggests that other items made up the sum in question. More significant was the inexplicable failure of the husband to specify the actual numbers making up the elements which Mr Bishop contended were completely irrelevant for maintenance pending suit purposes. It was striking that Mr Bishop’s advocacy about this issue was cast in generalities when his client was at all times in a position to instruct his financial advisers to provide the necessary breakdown. I agree with Mr Cusworth’s submission that the likely reason that no breakdown was supplied was that it would not have been helpful to the husband.

- In my judgment, the court should take the headline figure of £900,697 as being the stated global annual living costs of the applicant and the respondent for 2019. I make no deduction for items such as insurance, charity and furniture. In my judgment, the husband, having failed to particularise the value of the items which he says are irrelevant, should not be allowed to argue that some arbitrary proportion should be excluded.

- In the schedule the figure for the parties’ “discretionary expenditure not otherwise addressed above” in 2019 is stated to be £194,363 (see paragraph 16(ii) above).

- I agree with Mr Bishop that there is no basis for confining the husband’s element of the expenditure to 40%, and that it should be set at 50%.

- My calculation is therefore as follows:

|

Global annual living costs |

900,697 | |

|

Payments to dependants |

(459,140) | |

|

441,558 | |

|

50% referable to each party |

220,779 |

A |

| | |

|

Discretionary expenditure |

194,363 | |

|

50% referable to each party |

97,182 |

B |

| | |

|

expenditure on children |

62,662 |

C |

| | |

|

Total A + B + C |

380,622 | |

|

per month |

31,719 | |

- I turn to the claim for holiday money. The husband’s schedule states that in 2019 the cost of travel and holidays incurred by the wife and the children when with her was £475,000. That figure has not been challenged by the wife. It corresponds to a monthly rate of £39,583.

- Therefore, on the best available evidence, for the last calendar year of the marriage, namely 2019, the total sum relevant for maintenance pending suit purposes spent by or on the wife, other than on property and staff overheads, was £380,622 + £475,000 = £855,622, a monthly rate of £71,302.

- The wife has not submitted an interim budget. I agree with Mr Cusworth that this was not necessary on the particular facts of this case, just as one was not necessary in Rattan v Kuwad on the particular facts of that case.

- In my judgment, on the facts of this case, a reasonable figure for maintenance pending suit is the same amount that the wife had for discretionary and holiday expenditure in 2019. I disagree with Mr Bishop’s submission that the wife’s historic freedom to spend extremely large amounts on holidays should be curtailed during this interim period. In my judgment, a reasonable award would be to give the wife the same holiday spending power that she had in 2019.

- I therefore award the wife maintenance pending suit, to include maintenance for the children (but not including their nursery fees or the fees of any staff referable to them, which will be paid separately by the husband) in the sum of £71,300 per month. Mr Cusworth had sought that the discretionary (as opposed to holiday) element should be backdated with credit given for sums paid, but I indicated to him that I was not minded to do so as this would no doubt lead to extensive, furious and ultimately pointless disputes between the solicitors as to the calculation of the sums that should be credited against the backdated element of the award. Therefore, the first payment of £71,300 will be on 1 March 2022 and the payments will continue until determination of the substantive proceedings. However, I do not close the door on the wife’s backdating claim. It will be adjourned and, if the wife chooses to pursue it, determined at the substantive hearing.

- This award is only a minority element of the overall liability which the husband must meet in the interim. In paragraph 38 above I stated that the cost of the staff and other overheads were calculated at £2,781,469 in 2020. These expenses the husband has formally undertaken to pay. I am not fixing the husband’s liability in this amount, of course. He must pay those expenses in their actual amounts, whatever they are. But £2.78 million is in my estimation a reasonable approximation of the annual rate of the expenses at the present time.

- The annual rate of my above award is £855,600.

- The husband’s overall liability under my order will therefore be at an approximate annual rate of £3.64m.

- That is my judgment.

_____________________________________