His Honour Judge Bird :

Introduction

- Gas Tag Limited (“the company”) was incorporated on 12 February 2015. Its purpose was to market, sell and exploit the potential of a novel and life-saving gas safety product, a small tag containing a NFC (near field communication) chip which would be attached to a domestic boiler. NFC is a wireless technology which allows the transfer of data between two NFC enabled devices. The company created a smartphone app for gas engineers which would allow them to access the gas tag data. Such data would detail service records and other relevant information. The data would evidence compliance with gas safety checks and build a database of work carried out at a given property.

- The company entered administration on 14 October 2020 and was dissolved on 18 January 2022. For the purposes of this petition, it was restored to the register on 17 September 2022.

- This judgment deals with an unfair prejudice petition issued by Mr Paul Durose and then adopted by the second to sixth Petitioners. In brief summary, the petitioners say that a private equity investor engineered an insolvency event which allowed it to trigger certain enhanced voting rights and then issue to itself a large number of shares thereby giving it an overwhelming majority and so effective control of the company. In addition, Mr Durose says he was unfairly excluded from the management of the company. The Petitioners invite me to take account of certain assurances which they say led to a “legitimate expectation” (which the court should uphold) that the enhanced voting rights would only be triggered as a last resort if the company was “about to go under”. The Respondents deny any unfair prejudice and assert that any actions taken by the investor were in any event not concerned with the management of the affairs of the company.

The Trial

- The trial took place over 9 days. The parties agreed that I should determine if there has been unfairly prejudicial conduct before considering what, if any, remedy might be granted. Although there are expert reports, the issue of expert evidence has therefore been put off. The parties suggest that I can decide (if the Petitioners succeed in establishing conduct in the management of the company which is unfairly prejudicial to them) the point at which share valuation should take place.

The Parties

- The petitioners are Paul Durose (“P1”), Richard Foy (“P2”), Paul Davies (“P3”), Edward McDonald (“P4”), Thomas Green (“P5”) and Barry Witter (“P6”).

- The petitioners subscribed for shares in the early days of the company. The original shareholders included Stephen Ullathorne (“SU”) and George Dutton (“GD”). Neither is a party to this Petition. SU issued a separate petition which has been compromised on confidential terms and GD appeared as a witness for the Respondents. He was the finance director of the company and is a chartered accountant. I did not hear from SU. Phil Goodwin was the chair of the company until August 2019. He is not a Petitioner, and I did not hear evidence from him. I read the agreed witness statement of Stacey Goodwin who was P1’s personal assistant.

- The first respondent (R1) is Tagco BV, a special purpose investment vehicle incorporated under the laws of the Netherlands. It held shares in the company following an investment by the second Respondent, Waterland Private Equity Fund VI CV (“Waterland”). The company is the third respondent. Waterland Private Equity Investments BV is a fund manager based in the Netherlands. Waterland is one of its funds. Waterland Private Equity Ltd (“WPE”) is a UK adviser to Waterland dealing with UK investment opportunities and ongoing UK investments. The team allocated by WPE to the company comprised (in order of seniority) Andy Scaife (“AS”), Ryan Hallworth (“RH”) and Calum MacEwen (“CM”). Hans Scheepers is a member of the senior management team at Waterland.

Structure of this judgment

- I will deal with the evidence I heard at paragraphs 10 to 24 and then deal with the chronology of events as I find them to be by reference to the evidence and to the disclosed documents at paragraphs 25 to 120. I set out the pleaded basis of the Petitioners’ claims at paragraphs 121 to 129 (and deal there with an application to amend). At paragraphs 130 to 143 I set out the law and at paragraphs 144 to 152 I set out some initial but important findings in respect of the Petitioners’ case. At paragraphs 153 to 180 I deal with the issues and then at paragraph 181 and onwards I express my final conclusions.

- In reaching my findings and in setting out the chronology of events, I have borne in mind that in a case such as this, disclosed documents are likely to be of far greater assistance than oral evidence.

Evidence

- I heard oral evidence from P1 and P3 to P6, Mr David Holden-Locke, Michael Jones and Stephen Collins for the petitioners. I did not hear from Mr Foy. He served a witness statement in accordance with directions but did not appear. For the respondents I heard from RH, GD and CM.

- The principal witness for the Petitioners was P1. I am content to accept RH’s description of him as bright, energetic, optimistic, passionate and a “classic entrepreneur”. He had strong confidence in the product and assumed that having been introduced to the product “people would sign up the very next day”. He thought “it was all going to be a bed of roses; everybody would take the product and cash would come in". His confidence in the product, and so in the future success of the business, was overwhelming. It was also misplaced. Customers did not buy the product and the cash did not come in. I formed the view that he found it difficult to accept that the excellent opportunity presented by the product had been lost. His zeal and confidence in my view clouded his recollection of events. I reached the view that much of what he said was unreliable.

- Mr Holden-Locke is a public affairs consultant retained by the company. Mr Jones is the regional managing director for Gallagher a large insurance broker. Both gave evidence about the future prospects of the product. Mr Holden-Locke formulated a political strategy for the company, arranging access to MPs and Ministers in Scotland as well as in Westminster, lobbying amongst other things to reduce VAT on gas safety products. Mr Jones was working to bring the product to the attention of insurers who might have promoted and perhaps supplied it to homes they insured (in the same way, as he told me, insurance companies had promoted fire alarms 25 or 30 years ago). Each worked hard on the project in a professional capacity, and each gave their evidence carefully and truthfully. Their evidence corroborated the accepted view that the product had a real potential. Their evidence did not assist with issues of unfair prejudice.

- It was striking that, P1 aside, the petitioners had no understanding or knowledge of the dispute that brought them to court. None was at all troubled by that fact and each was happy to accept it when questioned about it by Mr Harper KC and Mr Parfitt (who cross-examined P4 and P5). I formed the view that each petitioner was an unwavering supporter of all that P1 said and did. Each had followed him into the litigation because of a blind and deep faith in the viability of the product and a profound trust in him. I did not find the evidence of the petitioners (other than P1) particularly helpful.

- RH and CM on the other hand, were impressive and balanced witnesses who gave their evidence in a dispassionate and professional manner. Unlike the petitioners, they had no emotional attachment to the company. They saw the potential of achieving a good return on the Waterland investment, but it seemed to me that they were acutely aware that the investment they oversaw was far from risk-free. They are in effect professional investors. Their interest was in making money, not friends. I formed the view that whilst RH was clearly on good terms with P1, he and CM maintained a professional working relationship with the Petitioners and were very conscious of their responsibilities as directors of the company (RH for a longer time than CM). I formed the view that GD was also an impressive witness. He, like RH and CM took an objective and professional view of what had happened and gave his evidence clearly and persuasively.

- I did not hear evidence from SU or Mr Adrian Webb, both of whom played a significant role in later attempts to raise finance. Neither did I hear from Mr Rathbone, the company’s solicitor who was actively involved with those later attempts to raise finance.

Mr Foy’s evidence: its admissibility and its weight

- I was told that Mr Foy, who lives in Dubai (but gives an address in Liverpool in his witness statement), was unable to attend the trial because he was too unwell to travel. No real explanation was given as to why a remote video link could not be arranged.

- To support Mr Foy’s claim that he was too unwell to travel, I was shown 2 medical reports. One referred to an operation in Dubai on 31 July 2022 to correct a deviated nasal septum and to undergo bilateral trimming of partial inferior turbinate. It was not suggested that the procedure was a particularly onerous one. The second report suggested that Mr Foy suffered an allergic reaction to post-operative antibiotic treatment which rendered him unfit to fly for 5 weeks. The latter report, as presented to me, was dated 29 August 2022. That would mean that the 5 week inability to fly would expire on 3 October 2022. Basic investigations by the respondents’ solicitors revealed that the date on the medical report had been changed. The original date was 19 September 2022. In an email addressed to her husband’s solicitor and dated 28 September 2022, Mrs Foy (who appears to have dealt with Mr Foy’s solicitors) explained that Mr Foy was due to fly to England on 19 September and that Mrs Foy “asked the doctor to provide [her] with [an] unfit to fly certificate for [Mr Foy]”. The certificate when provided was dated 19 September. Mrs Foy then asked the doctor to change the date to 29 August 2022, the date “treatment” started. Complying with the request, the doctor changed the date.

- The general rule (which, in appropriate circumstances, may be departed from) is that evidence at trial is to be given by way of oral evidence (see CPR 32.2(1)(a)). By CPR 32.5(1) where a witness statement has been served by a party, that party must call the witness if he wishes to rely on the evidence. The evidence may however be admitted if the statement is put in as hearsay.

- Mr Harper KC submitted that this general approach does not apply when the witness statement is that of a party. He referred me to the White Book note at 32.5.3.1: “where the court proceeds with a trial in the absence of a party who has filed witness statements, those statements are not hearsay evidence put in by them.” In my judgment that guidance does not apply in the present case. Where a party attends at trial by his solicitor and counsel the party is taken to be “present” (see White Book note 39.3.4). It follows that I should not proceed on the basis that the trial proceeded “in the absence of” Mr Foy.

- A hearsay notice has been produced. It includes the explanation of events provided by Mrs Foy I have rehearsed above. There is no explanation for his non-attendance directly from Mr Foy. There is no suggestion that he is so incapacitated that is impossible for him to provide a short witness statement for example.

- In response, the respondents suggest the hearsay notice “raises more questions than it answers”. I agree.

- In my judgment there is no reliable medical evidence that Mr Foy was not fit to attend the trial. The unfit to fly note was presented to me with a false date. The attempts to explain the change of date seem to me to be half-hearted at best and in any event insufficient. Assuming the explanation I have given is true, I find it deeply unsatisfactory that a medical professional would change the date of a report simply because he was asked to do so. I can have no confidence in the content of the second medical report. There is no explanation at all of why Mr Foy could not have given evidence by video link. I accept that permission may have been needed from the foreign state for such a link, but I have had no submissions (or evidence) on the point.

- Despite these failings, Mr Foy’s witness statement is admissible (see sect.2(4) of the Civil Evidence Act 1995). The real question is how much, if any, weight should be attached to it. In considering weight, section 4 of the 1995 Act provides that regard may be had to a number of factors including: whether the maker of the statement could have given evidence, whether the maker of the statement had any motive to conceal or misrepresent matters, and whether the circumstances in which the evidence is adduced are such as to suggest “an attempt to prevent proper evaluation of its weight”.

- I have come to the conclusion that no weight at all should be attached to Mr Foy’s evidence. I reach that conclusion for a number of reasons. There is no proper explanation for his absence, or ability to give evidence by remote means. Importantly, against that background, it seems to me that Mr Foy’s failure to give evidence strongly suggests a desire to avoid cross examination.

The chronology

Early trading and Waterland

- Forecasts for sales of the product were optimistic and unscientific. It is now clear that they were based on little more than general estimates. No thought had been given to the need for purchasers to go through procurement processes or the risk that Housing Associations might not be keen to act as early adopters of new technology. Actual sales, and so cash generation, were unimpressive. By 1 August 2017, the company had only 3 customers and had signed up only 16,401 individual properties.

Waterland internal discussions

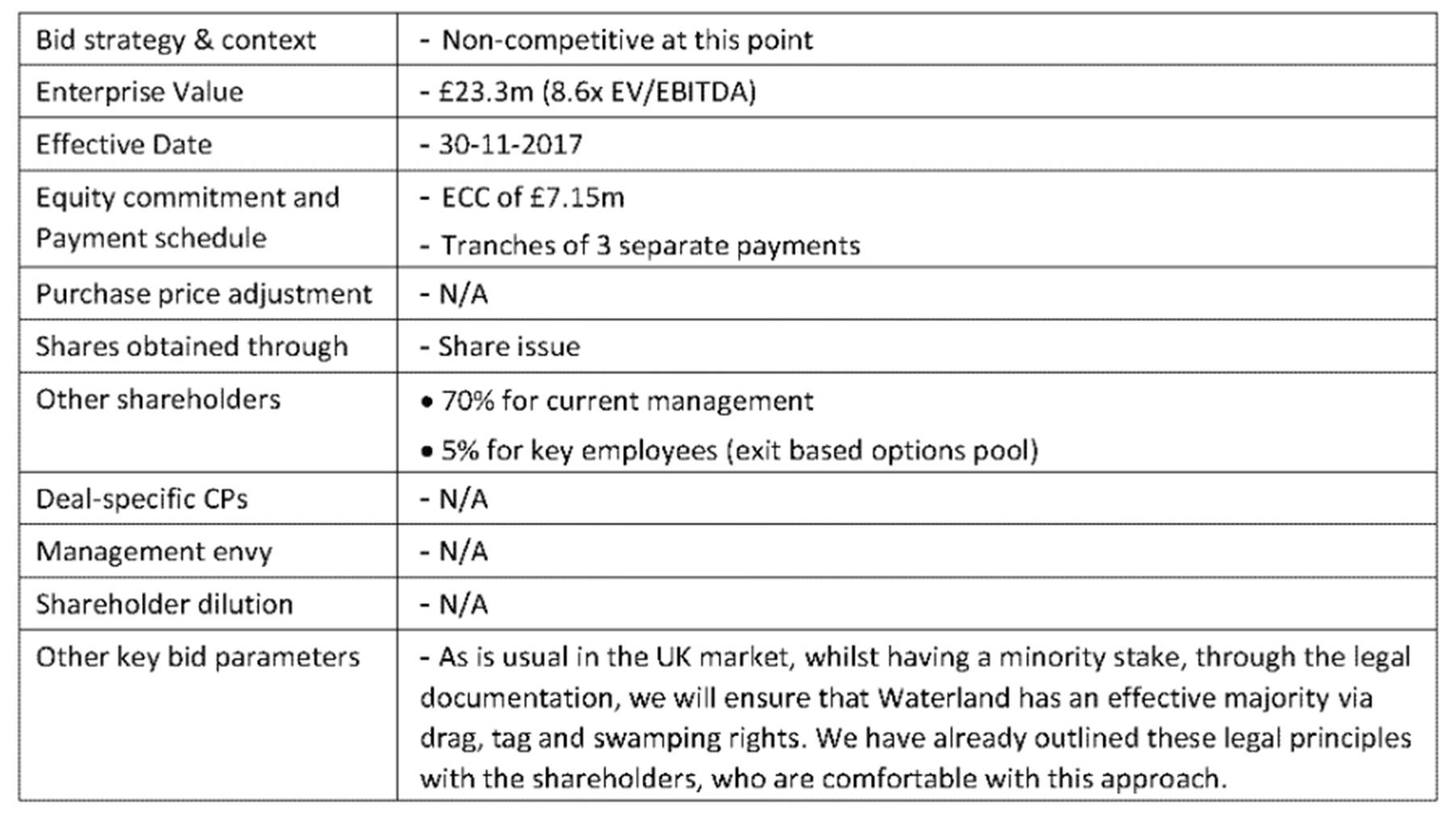

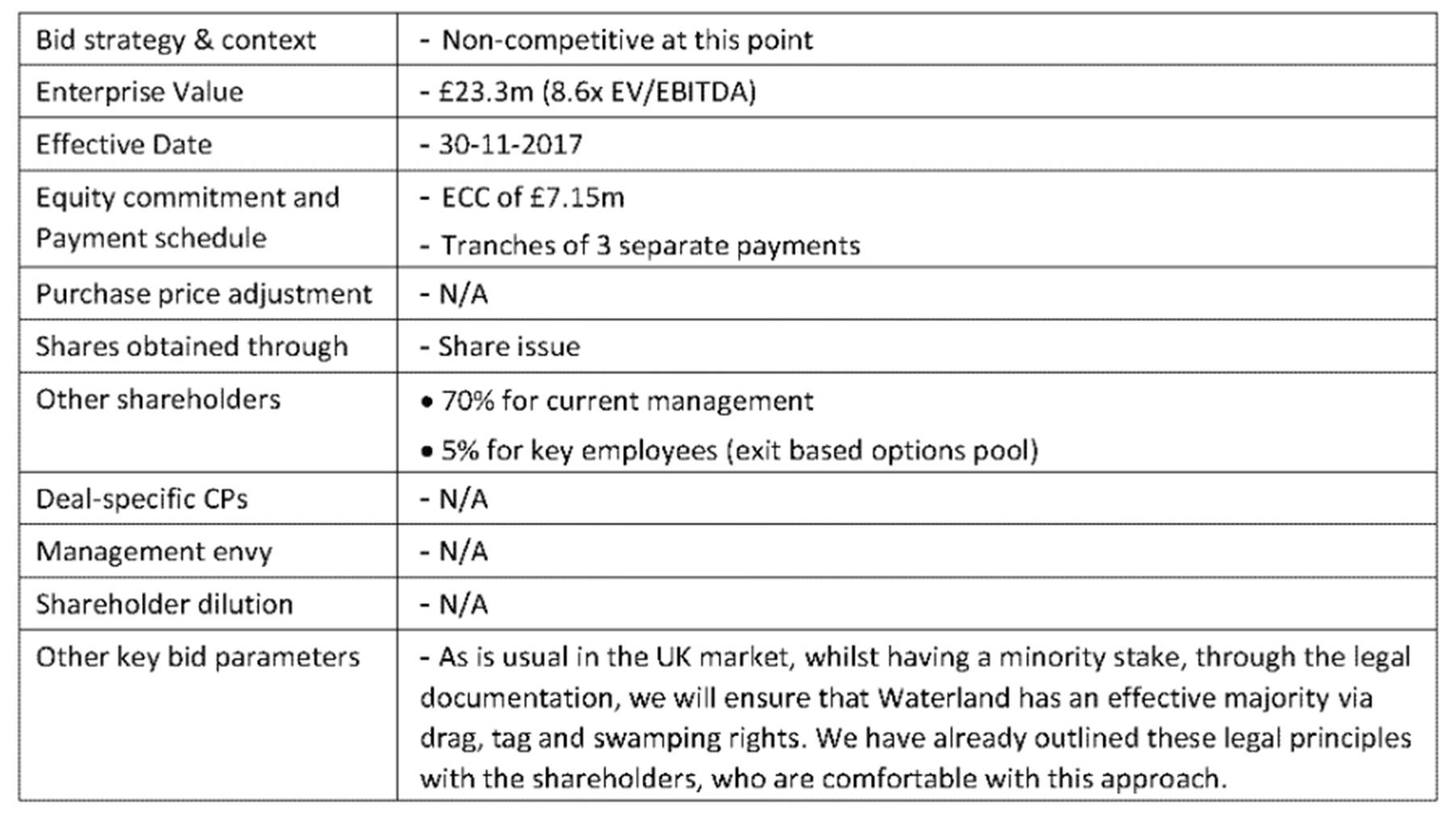

- Waterland was introduced to the company in June 2017 by P5. By September 2017 it had put a valuation on the company of £23.3m and was interested in acquiring 30% of the equity for £6m with a £1m earn out. An internal WPE document (not therefore seen by any of the Petitioners) addressed to Waterland and dated 29 September 2017 noted that:

“While the initial stake will be a minority, Waterland will look to grow its stake going forward should the opportunity arise. This will likely be achieved by further injections of cash to support the growth of the business through expansion into Europe and Canada, by supporting the growth of the business through acquisitions, as well as potentially acquiring shares from seed capital providers. The legal documents will provide us with the effective majority control (drag, tag and swamping rights) in certain default circumstances and provide veto rights over material changes to the business - this is typical in the UK for this type of transaction and has already been agreed with the shareholders.”

- In the same document and following this extract, WPE set out a table summarising the position as follows. The words against “other key bid parameters” are relied on by the Petitioners as evidence of an early intention to morph its minority interest into a majority interest:

Dealings between WPE/Waterland and the company

- By 2 October 2017 investment discussions were at an advanced stage. WPE had appointed Hill Dickinson as its solicitors and instructed the firm to draw up heads of agreement. The broad outline of the proposed deal had by then been discussed and was understood by the parties. There was never any doubt that the investment would be on strict terms recorded in formal legal documents. WPE sent an email to P1, SU and GD setting out some of the terms that would be included in the documentation. These included drag along and tag along rights and, as RH put it in the email:

“Wording that provides the private equity investor with protection and additional voting rights in specific default situations or in relation to significant and material changes to the business.”

- Board minutes of 5 October 2017, record that an offer had been received from Waterland to invest £7 million for 30% of the business with the shareholding to be held by R1. Given the obvious poor sales performance, it is plain that Waterland was interested in the company’s potential. Its view was supported by due diligence reports prepared by CIL (in respect of operational matters) and by Deloitte (in respect of financial matters). Neither report analysed the sales forecasts. I take from that that Waterland was prepared to form its own view on potential.

- The precise mechanism of investment was obviously of some importance to the original shareholders. The evidence shows that there were discussions between Waterland (acting through WPE) and the original shareholders about those terms from September 2017 at the latest and probably from much earlier. On 16 October 2017 RH emailed P1, to record recent discussions about warranties that would be offered to Waterland (RH assured P1 that these would be “light touch”) and about certain “swamping” (enhanced voting) rights. The email was passed on to SU and GD. RH wrote:

“To reiterate on the swamping rights, this isn’t designed to take away shares. This is a matter of last resort that we can take over day to day decision making, if the business is about to go under.”

- These early pre-contractual documents and discussions (the internal document of 29 September and the emails of 2 and 16 October) are relied on heavily by the petitioners. They invite me to conclude that the table within the internal WPE document of 29 September reveals an early intention to use swamping rights to gain a majority (“through the legal documentation, we will ensure that Waterland has an effective majority via drag, tag and swamping rights.”). Further, they suggest that the email of 2 October formed an integral and fundamental part of the agreement between WPE and the company which would limit the circumstances in which the swamping rights could be exercised and gave rise to equitable considerations capable of overriding or limiting the strict legal rights that were being negotiated.

- I do not accept that the 29 September document corroborates or establishes an early and improper intention to take a majority stake in the company. The table entry is intended to be a summary and must be read in context. The passage set out at paragraph 26 above provides that context. It describes a perfectly unobjectionable desire on the part of WPE to increase its equity stake in the company by investment and by acquiring shares from other members. The reference to the possibility of gaining control in “certain default circumstances” agreed by the members and recorded in the formal agreements is accurate. I find it impossible to read it as a statement of future intention. Further, as the chronology shows (see below), Waterland could have triggered the “swamping rights” in February 2019 but elected not to, instead providing funding by way of a loan.

- RH told me that his comments (by way of re-iteration) in the email of 16 October arose from a conversation with P1 and others who wanted comfort that Waterland would not “take the business away if we underperform”. RH stood by the words of the e-mail and agreed with GD’s evidence that it recorded the common understanding and was unambiguous. I accept his evidence. The email was intended to re-assure members that Waterland was prepared to accept the risk of underperformance but at the same time to remind them that it was not prepared to accept the risk of insolvency.

- I formed the view that this exchange of emails and discussion made it clear that P1 and all those involved were fully aware of how the swamping rights would be described in the investment documentation, and when they might be used. In particular they were aware of just how serious the consequence of the exercise of those rights would be.

- I am satisfied that all signatories to the investment agreements had an opportunity to consider the documents, had an input into them and had an opportunity to take legal advice on their contents. P1 accepted in evidence that he and the other shareholders took the investment with their “eyes wide open”. On 12 December 2017 Mark Rathbone, the company solicitor emailed SU, GD and P1 with drafts of the key investment documents asking for input. It is clear from that email that the documents being considered were drafts to which amendments could be made. An email of 14 December 2017 sent by the company solicitors to the petitioners, SU and GD had the suite of documents attached together with a report prepared by the company solicitors “to assist you in working through [the documents]”. There was no suggestion at trial that the report contained an inaccurate summary. The email again contained an invitation to raise any concerns. No concerns were raised. This further confirms that the members were well aware of what the documents would set out. If they had felt that the documents failed to record that swamping rights would only be exercised “as a last resort” I have no doubt that they (in particular GD and P1) would have raised the point.

- Before the terms of the investment were finalised, I accept that there was some talk of the possibility of further investment in the future. P1’s evidence was that Waterland had, in effect, put aside £30m for the company. P4 told me in evidence that he thought that Waterland would have been obliged to use that pot to fund the company when it needed money because he considered Waterland to be: “caring custodians of the company… [who were] there to look after all shareholders”. In my judgment it is clear that P4 had fundamentally misunderstood the relationship between Waterland and the Petitioners. I accept the evidence of RH on this point. He accepted that Waterland had “ringfenced” £30m for the company but explained that:

“the ring fencing is an internal procedure that we have, because we execute a buy and build strategy. So, we like to have internal allocations of funding for acquisitions…. That’s what we are talking about here. That money is available and can’t be spent by any other portfolio company, but it can only be released [on] case by case basis…. The follow on funding must hit the same investment criteria. And that is decided by the [the main board of Waterland].”

- I also accept that P1 let it be known before the investment that if the time came for him to be replaced on the board (because he was “not the right person” to take the company forward) he would want to remain in a non-executive role. P1 told me he accepted that he would “step aside” if the business needed a more experienced CEO. He told me that nothing was “set in stone” about this arrangement and accepted that he did not bring it up when the investment terms were being negotiated. I am satisfied that the discussion referred to was limited in its scope. If the company was doing so well that an experienced CEO was needed to lead it for example to a flotation, then P1 accepted he would step aside but would want to retain a role in the company. This discussion fell far short of a firm agreement that P1 would participate in the business no matter what or receive full value for his shares if he left.

The investment terms

- Investment documents were executed on 15 December 2017. They included new Articles of Association which provided for R1 to exercise enhanced voting rights in certain circumstances and the right for Waterland to make emergency equity investments in return for new shares whilst postponing the rights of other members to catch up. The articles also placed an effective prohibition on the sale of shares without Waterland’s consent. Loan amendment and restatement agreements provided that each founder shareholder who had lent the company money agreed not to seek any repayment of such loans until the terms for repayment set out in the investment documents had been met. AS and RH were appointed directors. An investors’ agreement (at clause 23.2) provided that the suite of investment documents (included the new Articles of Association) comprised the entire agreement and understanding between the parties and superseded and extinguished any prior agreement.

“Swamping rights”

- The Articles make no specific reference to “swamping”. The route to swamping was laid out in the Articles as follows.

- In certain defined circumstances (defined as instances of “Material Default” and including the occurrence of an “Insolvency Event” defined to include any group company being unable to pay its debts as they fall due), the Articles (see Art.4.5.2) permitted R1 to serve a “voting adjustment notice”. On service of such a notice, R1 would be treated as having 95% of members’ voting rights. Art.4.6.2 allowed R1 in these circumstances to remove and replace directors.

- Once there was a “Material Default”, R1 had the right under the Articles (Art.4.5.4) to provide emergency funding to the company by issuing new shares. In normal circumstances, if new shares were issued, all members would be able to participate. However, Art.9.3 postponed those participation rights and set out certain “catch up” rights instead. In effect the right to acquire shares was postponed. Art.9.3 required any member taking advantage of the catch up to provide a loan to the company proportionate to the size of any loan provided by R1 as part of the emergency funding.

The first investment

- In summary Waterland was to invest £6.8m as follows.

- £2.7m was paid on completion for a number of class A1 ordinary shares.[1]

- £2.5m for to be paid by way of share premium for a number of class B1 ordinary shares[2] on the earlier of the company’s acquisition of Millington Lord (“ML”) or 28.2.18. The sum was paid in February 2018, with the acquisition of ML taking place in June 2018.

- £679,000 re loans would be paid by way of share premium for a number of class B2 ordinary shares once the company had signed up 350,000 households at a minimum subscription of £6.50 per year[3]. This would be used to repay the members’ loans.

- £971,000[4] pursuant to an earn out mechanism once the company had an EBITDA of £3m.

- The investment was therefore to be provided in stages. The company’s preference was that WPE’s equity stake would increase as its funding increased. WPE however insisted on a full 30% stake (no greater portion of the equity was ever on offer) from the outset.

- The first stage of the investment was to be that WPE would make an equity investment of £5.2m to acquire 29% of the issued share capital for R1. P1 would hold 29.8%, P2 would hold 7.6%, P3 1%, P4 3.4% and P5 and P6 0.17% each. Of the remaining share capital, SU would hold 26% and Mr Goodwin 0.7%.

- The second stage was that £679,000 would be paid by way of a share premium for further shares once the company had signed up 350,000 properties at a minimum subscription of £6.50 per year.

- The third stage would be to pay £971,000 to members’ loans once the company had an EBITDA of £3m.

- In my view, the petitioners were all aware that this was not a risk-free endeavour. The report, the documents and the October discussions all made it plain that whilst underperformance on its own was not enough to trigger the enhanced voting rights (and swamping provisions), an insolvency event was. The double imperative of avoiding insolvency and achieving good sales (only effective sales could release the second and third tranches of funding) must have been plain.

Performance after the initial equity investment

- By the end of the 2017/2018 financial year, some 17,611 homes had been signed up. This was far short of the numbers Waterland had expected and represented a slow conversion of sales opportunities to sales. Nonetheless, Waterland remained optimistic about the future. Product development and some product expansion was however expensive and was causing a drain on working capital. Given the absence of hoped for sales revenue, by November 2018 it was clear that (despite Waterland’s investment) the company would run out of cash in February 2019.

- To address the shortfall, the non-investor members suggested that the second and third stage funding of around £1.65m should be released early. The founder members would need to forgo repayment of their loans and WPE would need to waive the requirement for 350,000 properties to be signed up and the £3m EBITDA requirement.

- RH supported the idea. In a report addressed to Waterland dated 6 February 2019 he noted that the company would need a cash injection by the end of the month for 2 reasons. Sales had been “significantly slower than originally anticipated” and there had been an increase in spending on personnel costs: “the business has roughly doubled its monthly personnel costs from April to December (going from £121k to £233k…) as a result of a necessary investment in recruitment in the sales and product development teams”. He expressed the view of his team (at WPE) that “the investment case for the business still exists and that [the company] could become a highly sought after asset if the [sales] pipeline converts…”. He noted that it was unable to meet its debts as they fell due.

- Waterland declined to follow his recommendation. Its decision is recorded at a meeting held on 11 February 2019. I accept that P1 was disappointed by this unexpected turn of events. I do not accept that there had any time been a promise or assurance that the second and third stages of funding would be released. Waterland stuck to the terms of the investment agreement. The fact that it declined to take the more flexible option (which would have involved a re-working of the investment agreement) is in my judgment important. It showed that Waterland regarded the terms of the commercial agreements as paramount.

- Minutes of the 11 February meeting (forwarded to WPE on the same day) record “approval to inject £0.5m equity subject to obtaining exit preference rights on the whole Waterland investment”.

Waterland’s offer of a £500,000 equity investment

- The funding deficit (and so the insolvency) had to be met somehow. Fundraising options were discussed at the January board meeting. The options were: temporary bridging loans from members, a further equity investment from Waterland or the introduction of third party equity investors. At that stage, the company was spending £283,000 per month. On 12 February 2019, WPE offered a £500,000 equity investment on a valuation of £10m (the second option). The email offer set out the following:

“It should also be noted that Waterland are not seeking to exercise any other rights that exist (re insolvency etc) …at this point.”

- Reference to “other rights” is a clear and obvious reference to enhanced voting rights and I find that P1 understood the email in that way at the time. Given the company’s insolvency, and with no obvious alternative means of raising working capital at that stage, I find that Waterland was in a position to exercise these “other rights”. The fact that it did not do so supports the conclusion I have reached that it had no fixed desire to obtain a controlling interest at any cost.

- The terms on which the offer was made were not well received. It was felt that the offer was “toxic” and P1 did not shy away from describing it as such. PG pointed out in a clear and persuasive email written to WPE on 13 February that the proposed terms would be likely to de-motivate the management team. The offer was rejected.

Waterland’s replacement offer of a loan of £750,000

- Instead, £750,000 was provided by Waterland by way of secured convertible loan notes issued by the company pursuant to a loan note instrument dated 21 February 2019. The instrument was approved at the company’s board meeting of the same day. The loan was repayable on 31 May 2019. In default of repayment Waterland would be entitled to convert the loan to an equity stake based on a £10m valuation (much lower than the original valuation but the same as that on which the £500,000 equity investment had been offered). The terms of the loan were considered onerous, but not so onerous that the company could reject the offer. The company continued to search for alternative sources of funding. It was noted at the meeting that the latest financial forecasts for the company showed that a loan of £750,000 “should be adequate” if there was an improvement in sales receipts. The willingness of the company to accept that loan on these terms in my judgment shows that it was well aware that absent the loan it would be insolvent.

- P1 told me in evidence that he had been pressurised not to take legal advice in respect of the loan notes. I reject that evidence. At paragraph 65 of his witness statement, he refers to a number of emails as evidence of that pressure. The emails show that WPE sent a copy of the loan documentation to GD on 19 February. They received an “out of office” reply. The documents were then sent to P1 with a rhetorical question: “[GD] is on holiday?”. P1 replied confirming that GD was indeed on leave and noting that he (P1) was in London all day. RH was not impressed. There was a clear and obvious urgency, and yet GD and P1 appeared to be taking a laid-back approach. His reply was: “seriously? Those documents need signing today.” This was a perfectly understandable reaction. There is nothing in the emails to suggest that P1 was under any pressure not to take legal advice.

- It is clear that in February 2019 (as had been forecast in November 2018) the company was in a very difficult position. It had run out of money. Waterland was in a strong position because it was the only viable source of immediate funding. No one suggested at this stage that it should simply pour in some of the £30m it had “ring-fenced” for the company (see paragraph 36 above).

- At the board meeting P1 offered “an outline equity financing plan” to inject £1m in return for a greater shareholding. Waterland would need to consent to the terms of the investment because it involved the acquisition of shares. It therefore invited a formal offer to be made in writing. On the day after the meeting, CM emailed P1 about the “various bits of detail” the offer should contain. These details are important. They included the need for P1 and P2 to demonstrate that he had available funds, show the source of funds and confirm that “no other parties, other than those stated in the written offer, were involved in the proposed deal”. Waterland wanted to understand if P1 (and P2) had the funds to make the investment from his own funds or if he would need to borrow to finance the investment. These points were clearly considered to be important.

P1’s offer of a £1m equity investment and offer to buy SU’s shares

- On 26 February 2019 P1 and P2 made a formal written offer to invest £1m for a further 4% share in the equity and at the same time to purchase Mr Ullathorne’s shares for £2.64m with both to complete by 31 May 2019. The £1m was to be used to redeem the loan notes issued by WPE. Its effect would therefore be to provide the company with £250,000 working capital (the equivalent of about one month’s spend) after the £750,000 debt had been paid.

- P1 (and the company) were rightly focussing on how the £750,000 loan could be repaid on time so that the draconian consequences of non-payment (conversion to an equity stake at a low valuation) would be avoided.

- In compliance with Waterland’s request for detail, P1 and P2 explained the source and availability of their funds (of around £3.675m) as the following:

- A property in Ibiza under offer for £1.4m owned by P2.

- 4 Gildart Street under offer for £1.1m. The registered proprietor was Rosebrey Limited, a company owned by P1 and P2.

- 24 Tithebarn Street valued at £900,000. P2 was the registered proprietor.

- Moss Lane valued at £550,000. P1 and P2 had an aggregate half share in the building and so each had a 25% interest in the proceeds of sale.

- There was no suggestion that P1 and P2 would need to borrow any money to finance the deal. It is important to note that the offer required that the sale of SU’s shares and the investment of £1m were to be simultaneous.

- On 5 March 2019, the offer was rejected. Waterland noted that it “remained keen to support the business, as demonstrated by the investment of a further £750,000 last week at a time when the business had run out of cash.” Given difficulties in achieving forecast sales Waterland were: “keen to ensure that the business is sufficiently and appropriately funded to provide it with headroom to allow for slippage…. It makes little sense to put in insufficient funds… we believe that an ideal to completely de-risk the business at this stage is probably in the region of £3 million.” Waterland felt that a cash injection of only £1m would be likely to:

“result in the business running out of cash again. Having considered the latest cash flow forecast and sensitivities based on historic and recent slippage, we believe that the business requires a minimum cash injection, by way of equity, of £2 million.”

- In an email of 5 March 2019 sent by AS to PG, AS noted that P1 had “a completely unrealistic expectation of what should have happened when the business ran out of money last week.” He had a “wholly unrealistic view of how fair Waterland has been” and was “not listening at all….ignoring reality….does not appear to be helping”. In my view this is a fair assessment of P1’s approach. It seems to me that P1 was overconfident. He felt the product was so good that the business was bound to take off (as he accepted in evidence, he thought “it was all going to be a bed of roses”).

- In response, PG suggested the company agree to a £2 million rights issue together with an option to purchase SU’s shares. There was clearly some discussion about how the sale of SU’s shares and the sale of company shares would fit together. Minutes of the board meeting of 21 March 2019 record that P1 wanted the sale of company shares to be dealt with first. He expressed the view that:

“….if the shareholders are not willing to participate in raising the £2 million required then they should not be given the opportunity to purchase the discounted shares.”

- The Petitioners argue that the rejection of the £1m offer was “unfathomable”. I cannot agree. It seems to me that it was entirely appropriate. The “minimum cash injection” required as was made clear on 5 March 2019, was £2m. Anything less would be a short term solution and so not workable. In reality it would have been prudent to raise more than £2m.

The share issue and offer and permitted sale of SU’s shares: terms and conditions

- The decision was made to raise funds by a share issue. The offer was put out on 1 May 2019 (“the Offer”). Members were to be offered newly issued shares pro rata to their existing shareholdings and the opportunity to purchase SU’s shares. The total of new shares on offer was 1,207,883 at £1.66 to raise £2,005,085.78. In addition, 3,661,991 sale shares (SU’s shares) were offered at £0.82. The sale of SU’s shares would not raise capital for the company. SU would receive £3,002,767.

- The Offer therefore contained 2 distinct offers. An offer (described in the letter as the “open offer”) to purchase new shares (“the new shares”) and an offer to purchase SU’s shares (“the sale shares”). The former was made by the company, the latter was made by SU with the company acting as his agent.

- The transfer of the sale shares was conditional on the “take up of not less than 1,207,833 new shares” and would only happen “following completion of the subscription for new shares under the open offer” (see paragraph 1.6). By paragraph 2.14 “the [new shares offer was] to complete prior to the sale shares offer” and by paragraph 3.10 the sale shares offer was conditional on “not less than £2,005,085.78 in total subscriptions being raised through completed applications… from subscriptions for New Shares”. Completion of the sale shares offer would only take place if the condition set out in paragraphs 3.9 and 3.10[5] had been “satisfied in full” and “payment in full of the sale price for the sale shares has been received by the company” (paragraph 3.19).

- The offer sets out the form of application to be submitted by those members wishing to take up the sale shares offer and the offer to acquire new shares. Acceptance of the sale shares offer was expressly on the terms and conditions set out in the Offer.

- The new shares offer was expressed to be open from 1 May 2019 to 9 May 2019 (later this was extended to 10 May). By 11 May, each member applying for new shares would be notified of the number of new shares allotted to them and the amount payable. The due sum was to be paid by 5pm on 16 May 2019. The sale shares offer was expressed to be open from 1 May to 5 June. Payments for sale shares were to be made by 5pm on 14 June 2019.

The underwriting agreement

- P1 and P2 agreed to underwrite any shortfall in the take up of new shares and sale shares. 90% of the consideration payable by P1 and P2 for SU’s shares was to be deferred for 12 months with a charge over Gildart Street as security. The effect of the agreement was to guarantee that the company would have the £2m required to allow its continued trading. The underwriting agreement is expressed to relate to “a fund raise by [the company] and to a proposed sale of shares in [the company] by Stephen Ullathorne”. Recital (B) emphasises that the company has decided “to raise funds from the shareholders”.

- Given the terms on which the 26 February offer to inject £1m was made, and in particular the detail set out in that offer of P1 and P2’s ability to raise money, there was no obvious cause for concern that P1 and P2 might not be good for the money due under the underwriting agreement. In any event, at clause 4.2.3.5 of the underwriting agreement P1 and P2 warranted that as at the date of the agreement each was “solvent and able to pay his debts as they fell due”. This probably amounted to an express warranty that each was able to meet the obligations set out in the agreement.

The contemplated order of dealing: new shares followed by sale shares

- I note that P1 had raised the issue of the order in which sales should take place at the board meeting of 21 March 2019 noting that the right to purchase SU’s shares should only arise once a member was “willing to participate in raising the £2m required”. In my view it is plain that the conditions attaching to the sale shares offer mirrored P1’s thoughts and required the full amount due in respect of the new shares to be paid before the sale shares purchase could complete.

- That meaning is plain from the language of the Offer which repeats the point more than once. It is difficult to imagine that clearer language could have been chosen. The meaning is also clear from the context against which the agreement was reached. Such context is to be derived from the general background I have set out above. Any other interpretation would not make commercial sense, would fly in the face of the context I have set out and would do violence to the language chosen by the parties (and their experienced lawyers) to record their understanding. The company needed to raise capital. It was prudent to ensure that the needs of the company were met before SU was permitted to sell his shares.

- It is accepted that the full amount due in respect of the new shares was not paid at any time. In fact, on 22 August 2019, P1 accepted that he could not raise the money he owed in respect of the new shares. It follows therefore, that no obligation to pay for the sale shares arose under the terms of the Offer.

Efforts to raise monies due under the underwriting agreement and the effect on the company of those monies not being available

- R1 subscribed for and was allotted new shares at a price of £770,465.75. It paid that sum. It was set off against the sum owed by the company to Waterland and the loan notes were therefore cancelled. PG subscribed for £23,339.60 of new shares and Mr Adrian Webb for £48,704.40. There was therefore a shortfall. The company had not raised the £2m it required. This had 2 consequences: first under the terms of the underwriting agreement, P1 and P2 were each required to subscribe to 350,174 new shares at an aggregate price of £581,288.84 each and secondly, no sale of SU’s shares could proceed.

- As far as the sale shares were concerned, R1 initially subscribed for £1,153,839.20. Mr Goodwin subscribed to £34,952.50 and Mr Webb to £29,999.70. That left each of P1 and P2 needing to subscribe £891,992 in respect of new shares (a total of £1,783,984) in the event that the full £2m was raised on the sale of the new shares.

- Despite the apparent confidence shown in their 26 February offer that they could raise £3.675m and despite their confidence (and warranty) that they could underwrite the new share sale, P1 and P2 were struggling to raise the sums due. It followed that the company was short of working capital. The only thing to have been achieved was the settlement of the loan notes.

- In June, cash flow at the company was in crisis. Board meeting minutes of 18 June 2019 record that the company needed to borrow £70,000 from ML. At the July Board meeting, GD reported that the business was facing “a major cash flow challenge” because of the delays in bringing in the proceeds of the share issue. Money from P1 and P2 was said to be expected that week. At that meeting P1 presented a 5 year plan which involved attempts to contract with insurance companies. Although P1 placed a lot of store in the 5-year plan nothing came of it. In my view the scheme was aspirational rather than achievable. This is another example of P1’s over-confidence and belief that “it was all going to be a bed of roses”.

- On 6 August 2019 GD emailed WPE. The financial position of the company was worsening. There were some payments made towards the underwriting debt, but around £550,000 remained outstanding. Having set out alternative cash flow scenarios he noted:

“there is …. an imminent and material risk that the business will have insufficient available liquidity to meet its payrolls, HMRC payments and other ongoing operational outgoings later this month…. Given the level of ongoing uncertainty surrounding the receipt of the balance owing for the new shares [and other income] the business urgently requires an injection of cash while the board of directors reaches agreement on a new business plan as well as the strategy for raising significant and sufficient funds to drive the business forward.”

- WPE noted (with a degree of understatement) on 12 August (in a report prepared for Mr Scheepers) that the latest 13-week cashflow forecast “indicates a potential short-term funding requirement to facilitate the payroll payment on 22 August” if P1 did not come up with the £554,000 then owed to the company A request was made to the parent board for “emergency funding” of between £300,000 and £500,000 to cover the August payroll, medium term funding of £2m and a long term capital investment of £10m. WPE noted that the company was in an “insolvency event” for the second time in 6 months.

P1 to borrow from SU and the meeting of 12 August 2019

- On 12 August P1, GD, Hans Scheepers (replacing AS), RH and CM met at the WPE offices in Wilmslow. This was not a board meeting. GD’s evidence (which I accept) was that the main purpose of the meeting was to discuss P1’s failure to provide the promised funding in respect of the new share issue. In context, it is difficult to believe that the meeting could have been about anything else.

- P1 was asked to explain his “failure… to fully comply with his obligations and commitments under the new share issue offer letter”. He offered an explanation, but it clearly failed to impress Mr Scheepers who is noted as saying that the failure represented “a serious breach of trust”.

- P1 then offered a solution that would allow the money to be paid before the August payroll was due, namely that WPE complete on its offer to buy SU’s shares who would then lend the money to P1. As P1 accepted in his evidence, this was the first time he had explained that he would need to borrow the money to meet his obligations. Both RH and Mr Scheepers “indicated this was not an acceptable solution” and “as the problem had arisen from P1’s failure to comply with the mutually agreed funding terms that P1 must find a solution”. The “mutually agreed funding terms” included the fact that SU’s shares would only be available for purchase (only released for sale) once the sale of the new shares had raised £2m. GD’s evidence was that Waterland made it clear that it would not “first purchase Steven’s shares before Paul completed on the rights issue.”

- In effect, P1 was asking that Waterland re-negotiate the terms of the Offer. Waterland in effect refused to do so. Once again, as it had in February of the same year (see paragraph 48 above), Waterland stuck to the terms of a clear and formal agreement rather than taking the more “flexible option” of renegotiation.

Did P1 say he had arranged an alternative source of funding?

- The note of the meeting records that there was a break to allow P1 to “make arrangements” to meet his obligations. It is recorded that after the break, he said the issue had been “sorted”. P1 denied that that was what he said. He told me in evidence that he clearly (“vividly”) recalled saying “I’ll sort it”. He accepted that there was no discussion about how he planned to “sort it”. He could not recall exactly what was said.

- P1 went on to say in cross-examination that on 13 August (the day after the meeting) he had spoken to Mr Webb and arranged to borrow the money from him. His evidence was that he then telephoned RH and said, “I’ve sorted it”. He told me “…as soon as I have arranged it with [Adrian Webb], I called Ryan and tell him”. Even on P1’s evidence, by 13 August he had told Waterland that he had “sorted it”.

- There is other evidence which supports Waterland’s version of what happened on 12 August. GD’s evidence is that after the break in the meeting P1 “appeared to come up with a sort of Eureka moment because he declared to the meeting that he had “sorted it”, although he did not reveal what the solution was”. Further, in a formal report prepared for Waterland dated 1 September 2019 (which Mr Scheepers and Mr Hallworth saw and therefore must be taken to have approved), it is recorded that P1 had said that funding was “sorted”.

- The minutes of the 12 August meeting are not contemporaneous, and it is accepted by all parties that CM, who took notes, left the meeting before the key conversation. I was told by CM that RH had relayed to him what had happened after he had left, and it is for that reason that the record of the meeting includes reference to matters not directly observed by CM.

- I find that P1 did say on 12 August that the funding was “sorted”. I reach that conclusion for a number of reasons: first, it is entirely consistent with P1’s general approach of overconfidence and optimism. Secondly, P1 was aware at the 12 August meeting that the company was in a very difficult financial position and was relying on the £554,000 to meet its payroll and other commitments. He knew the dire consequences that could follow if the company was insolvent. Had he confessed at that meeting that he had not “sorted” how he could pay the debt, he was aware that Waterland would be very likely to exercise its swamping rights. He also knew that Waterland was not prepared to re-negotiate the terms of the Offer and so his options were running out. I find that P1 knew he was in a very difficult position and wanted to provide assurance to Waterland that an insolvency event would be avoided. Thirdly, I accept GD’s evidence on the point. His reference to a “eureka” moment appears to show that he has a distinct recollection of the point. Fourthly, I accept that RH gave a truthful account of his recollection of the meeting to CM when the minutes were compiled.

The new plan to finance the share purchase through Mr Webb

- The new plan, arrived at on the basis that Waterland would not renegotiate the term of the Offer, was that P1 would borrow the required £554,000 from Mr Webb.

- By 6.47pm on 13 August 2019 P1 had discussed that new plan with Mr Rathbone, the company’s solicitor. It is clear from an email sent by Mr Rathbone to P1 that he was aware that “in order to move on the Stephen Ullathorne share sale, Waterland are requiring that the rights issue completes”.

- The broad outline of the transaction was as follows:

- P1 had 2 potential debts to deal with: the £554,000 immediately due to the company and (if that was paid) the sum of £178,398 representing 10% of the sum due to SU in respect of the sale shares if the new share sale completed.

- Mr Webb was to lend P1 £554,000 for a fee of £20,000. SU was then to lend P1 £574,000 once the sale of his shares had completed (which could only happen after the new shares sale had completed). At the same time SU would defer payment of £178,398.46 representing 10% of the sum due to SU from P1 and P2 as underwriters for the purchase of his shares until 31 December 2019.

- Mr Rathbone would hold £554,000 provided by Mr Webb. He would not be authorised to release that sum to the company on behalf of P1 and P2 (for the new shares) until he had received £574,000 from SU.

- The plan therefore required the sale shares to be sold (so that SU could pay £574,000 to Mr Rathbone) before the new shares were paid for (by the release of £554,000 to the company). This was the very arrangement Waterland had rejected. This problem led Mr Rathbone to acknowledge that:

“if I say I am in funds for the £554,000 they can ask if I am in funds to complete the share transfer, which I will not be….if I… say we will only pay over the £554,000 if we then immediately…complete the share sale they would be within their rights to say that if you are in funds under the underwriting agreement you are obliged to pay the monies into the company immediately…”.

- The arrangement was designed to make it look as if P1 and P2 could pay the £554,000 (or £550,000 as it became after a payment by P1 and P2 on 13 August of £4,500) before the share sale completed.

- P1 and P2 paid a total of £612,525.40 in respect of the new shares between 23 May 2019 and 13 August 2019. On 14 August they owed a total of £550,050.62.

The attempted execution of the new plan

- On 19 August Mr Rathbone emailed the Waterland’s solicitors (HDs) to say he was

“expecting to be in funds from Paul Durose to enable satisfaction of the remaining £550,00 under the Rights Issue. However, those funds are only being made available on the basis that the Stephen Ullathorne Share Sale completes simultaneously. I understand the parties have been in discussion and that this is accepted….I am expecting to be in funds for the £550,000 tomorrow.”

HD responded on the same day to say there had been no such agreement or acceptance.

- Mr Rathbone’s email accurately set out the position. In coming clean in that email, it was obvious that Waterland would maintain their position and insist that the terms of the Offer be complied with. The sale shares would need to complete, and the company would need to have the required £2m before SU received anything. HD were obviously entitled to respond as they did.

- Mr Rathbone replied saying:

“this is just proceeding along the lines of the agreed deal. The rights issue completes and is all paid up, meaning the share sale can complete.”

This response is difficult to explain. It seems to be to be at odds with Mr Rathbone’s email of earlier the same day. The transactions could complete simultaneously (which had not been agreed) or consecutively (as set out in the “agreed deal”). Simultaneous completion had not been agreed.

- Mr Webb intended to pay the relevant sum to Mr Rathbone on 20 August 2019 on condition that Waterland was “on board”. If Waterland was not “on board” then he would be exposed to a risk that P1 would not repay him. At a meeting of the company’s board on that day it was noted that P1:

“confirmed he is now in funds to complete on his obligations as part of the open offer resulting in a final payment of 550k to be made to the company via Brabners [Mr Rathbone’s firm] client account by 21 August at the latest.”

He went on to say (and the minutes record) that he intended to complete the sale share acquisition “once he had completed his transfer of funds to the company”. In other words, the minutes record an intention to deal with the new shares and the sale shares in precisely the manner set out in the Offer and agreed by all participants. The actions recorded in the meeting include that P1 was to transfer £550,000 to the company to allow the August payroll to be met.

- The information given to the board was not consistent with the arrangement reached with Mr Webb. The company (and Waterland) did not consent to that arrangement and so Mr Webb did not advance the required funds. Brabners were therefore never in funds and the £550,000 could not be paid. P1’s plan had no prospect of success.

WPE defer purchase of the sale shares

- At the board meeting of 20 August 2019, R1 communicated that it intended to defer completion of the SU shares. The minutes note RH said that “to complete on this transaction” would be “in conflict with his duties as a director to uphold the interests of all stakeholders”. Waterland still apparently intended to complete the purchase of the sale shares at some point, “however the position is to defer this given the uncertainty the business faces.” The decision to defer is curious. There would be no need to defer unless the full £2m due to be raised from the new shares was received. As it was not received there was no need for a deferral because the obligation to pay for the sale shares did not arise.

- In a report dated 1 September sent to Waterland, WPE note (under the heading “context”) that Waterland had approved R1’s acquisition of sale shares at a price of £1.1m. The acquisition was accurately described as a “back to back transaction concluding upon the completion of the rights issue all participants. As detailed below, the rights issue did not complete……. therefore, WP chose not to acquire [SU’s] shares”. In my judgment, the “choice” Waterland had was to strictly apply the terms of the Offer and not pay SU for his shares until the new shares had been paid for, or to tear up the Offer and pay for SU’s shares in any event.

- There was no suggestion at the time (or before me) that the decision was in any way contrary to the terms of the Offer. The Petitioners rely on the deferral as part of the company’s conduct said to have been unfairly prejudicial to them. In particular they are concerned that WPE more than once let it be known that it did not wish to make SU “a millionaire”.

Was R1 entitled to defer purchase of the sale shares?

- R1 was entitled not to complete the sale shares transaction for the reasons set out above. It was entitled not to complete that sale until the company had received £2m from the sale of the new shares.

- It follows (although the description seems inapt) that R1 was entitled to “defer” the purchase. It was entitled, on 20 August, not to go ahead with the purchase.

- The point was made on 20 August by WPE’s solicitors in an email sent at 20.41. It noted that the share sale “cannot complete” until the “rights issue has completed and is fully paid up”.

- Mr Rathbone replied on 21 August, he noted that P1 would need to pay not only the £550,000 he owed in respect of the new shares, but also £294,000 in respect of the SU share acquisition. He noted that P1 and P2 as underwriters would be ready to meet their obligations at the end of the week. This appears to be a recognition that the sales would need to proceed in the order contemplated by the Offer. It appears that P1 was negotiating with P2 to raise funds.

- RH emailed Hans Scheepers on 21 August noting that a draft “swamping notice” was prepared and ready to send. I do not find that surprising. It must have been obvious to everyone that P1 had vanishingly small prospects of coming up with the money.

- RH refers to an offer made by P1 to enter into a call option in respect of WPE’s allocation of SU’s shares. In his evidence, RH explained that P1 had offered to “formalise the deferral and have a call option because it would be helpful for him”. RH’s evidence was that the option would “settle down Richard Foy and the £550,000 could be released”. In other words, as RH explained in his evidence, if the call option had been agreed, “the £550,000 would have been released by Richard Foy, would have gone into the business, the payroll and the outstanding creditors would have been paid and we would have all moved on with life.”. In fact, nothing came of this idea because P1 or (more probably) Mr Foy elected not to take the call option.

- On 22 August Mr Rathbone emailed GD and P1. He suggested that WPE wished to withdraw their application to acquire SU’s shares and that others who had submitted offers also wished to withdraw. The effect was that P1 and P2 were now required to underwrite the purchase of all of SU’s shares (with the possible exception of a small allocation to Adrian Webb). Mr Rathbone noted: “as the applications were in any event made late and were being held essentially pending completion of the subscription for shares under the rights issue, it would be difficult to look to enforce the applications and demand the funds are paid over. This in any event, would not be in the best interests of the company, given the discussions between you and Waterland over the last few days.”

- Mr Rathbone went on to say:

“if, Paul, you declared that you were in funds earlier this week to complete on the £550,000 and that those funds were in our client account, when they weren’t, it is possible that if the swamping rights do arise, the swamped board could declare that you have been dishonest with it.”

- P1 continued to make efforts to raise not only the £550,000 but also the funds he and P2 would need to complete the purchase of SU’s shares. Those efforts came to nothing. On 22 August 2019 he emailed RH in these terms:

“… I will not have the funds from Richard to complete on the completion of the rights issue or Stephen’s shares…. The money that was there earlier this week has now been pulled by Richard as he doesn’t want to take part in his element of the Rights Issue any more. I appreciate that I have underwritten it and I will have to fulfil that obligation to the business. This has not ended in the way that I wished but I know that because of this news we will not be able to make payroll on Wednesday and this needs to be addressed in an emergency fund to meet this obligation. I have been trying to solve this and got out of my depth and I apologise.”

- On 23 August 2019 GD set out sums owed by the company and due to be paid. In addition to the payroll debt (£125,431 due on or about 22 August):

- £70,977 was owed to HMRC

- £78,339 was owed to suppliers

- £100,000 was due to be repaid to ML by 30 August 2019

- £28,215 was due to suppliers at the end of the month

- Around £11,000 was due to due to be paid to staff for expenses

Voting adjustment notice and swamping notice

- On 23 August, a voting adjustment notice was served in accordance with Art.4.2 of the Articles because there had been an “insolvency event”. R1 then exercised the rights afforded to it by Art.4.6.2 to remove SU as a director and to appoint CM and Judy Martins as directors.

- A written resolution was then circulated the effect of which was to “swamp” the shareholdings of the other members. On 26 August 2019, at a board meeting, 4.86 billion new shares[6] were issued so that R1 held a 97% equity stake. R1 granted the company a loan facility of £1,153,000 in order to provide the company with emergency funding.

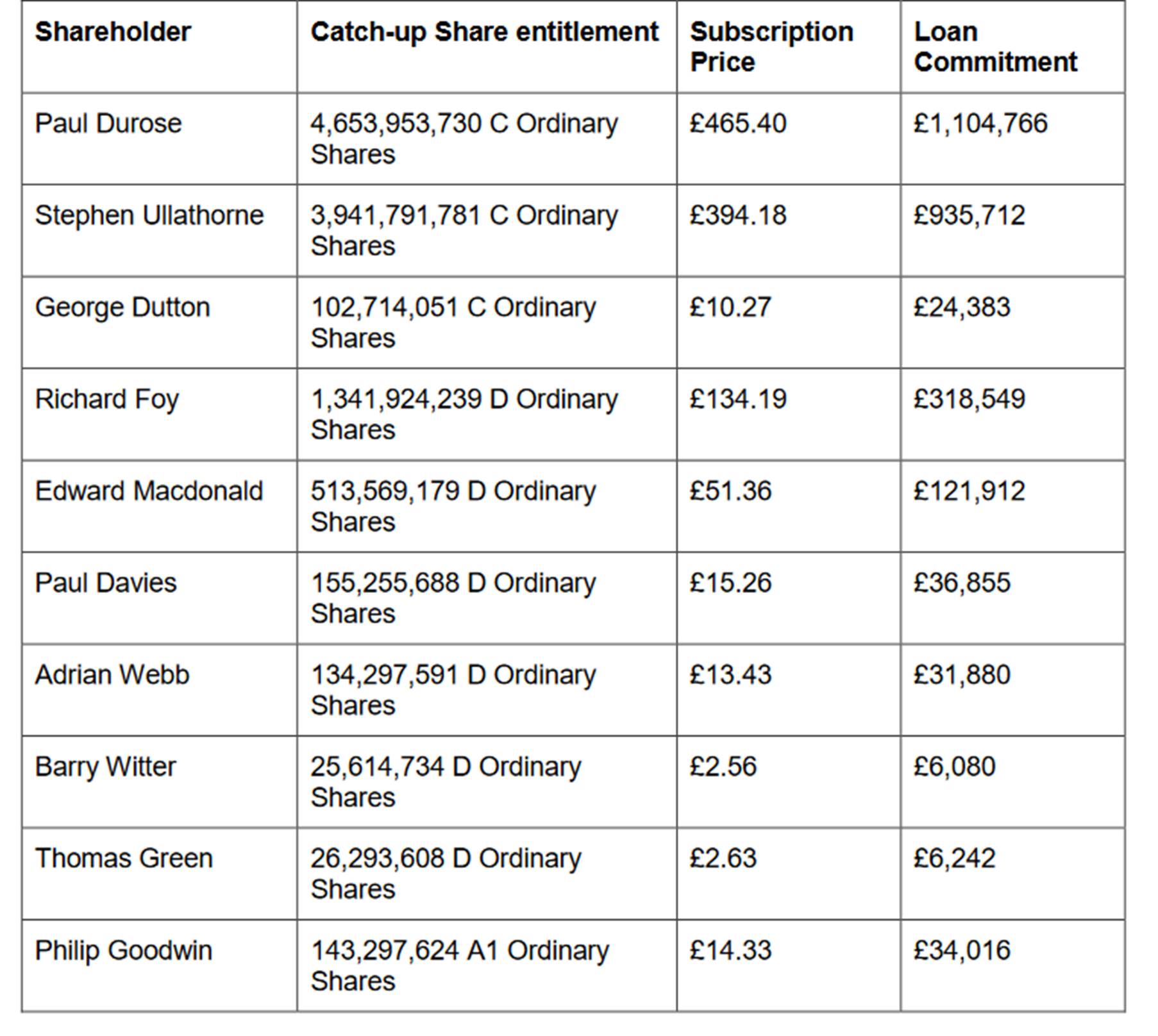

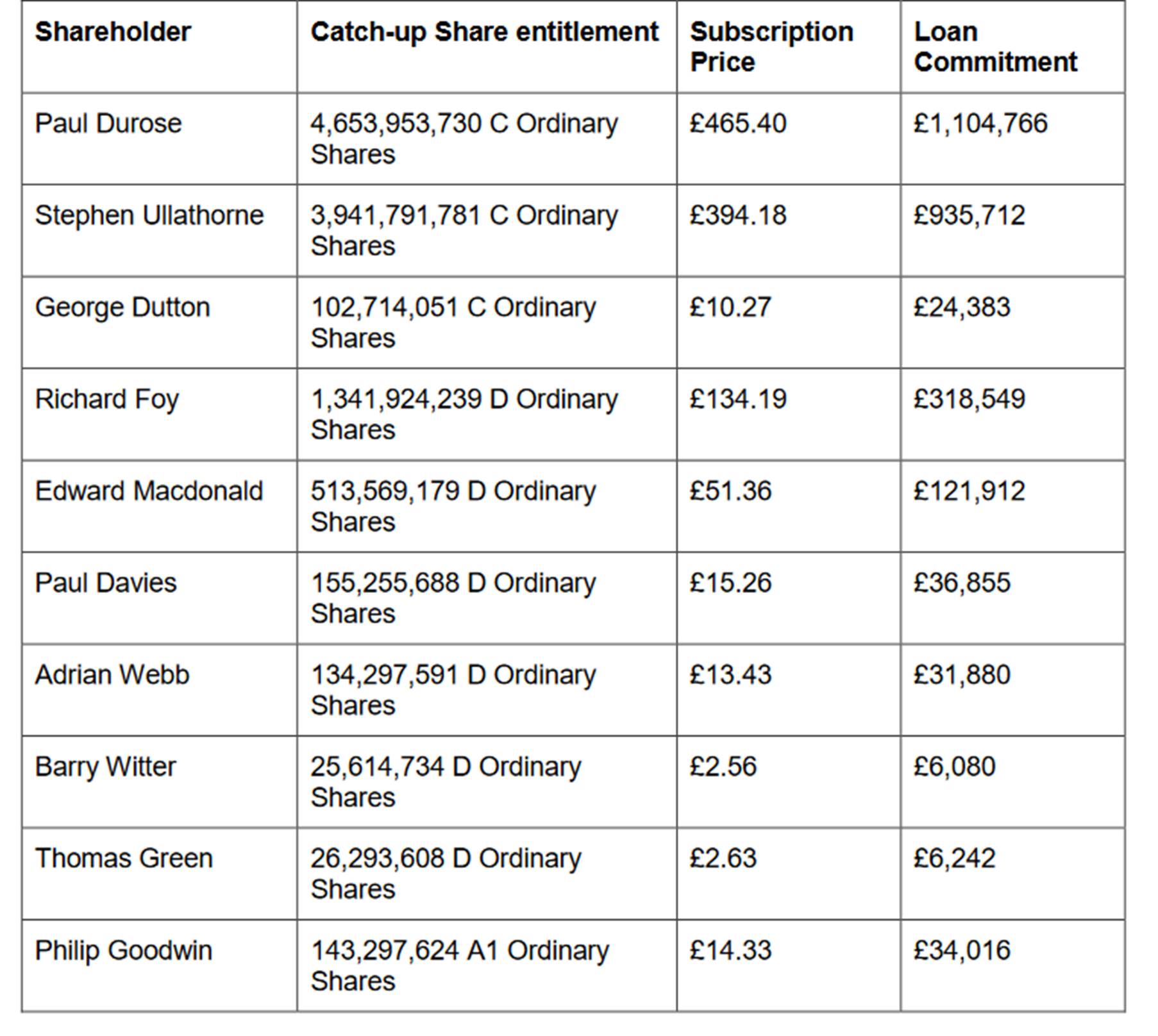

- On 4 September 2019, in accordance with the catch-up rights set out in the Articles, the company offered shares to each member and required (again in accordance with the articles) each member who took up the offer, to offer a proportionate loan to the company. The effect was as follows:

- Although pleaded in outline, the Petitioners did not argue at trial that the process of swamping and catch-up was not carried out in accordance with the Articles of Association. None of the Petitioners took up the right to the new shares (although Mr Webb and PG did). Each told me in evidence they felt they should not need to buy back what was what already theirs. That was of course a matter for them.

- There is no issue between the Petitioners and the Respondents that there was an insolvency event at the time the swamping notice was served. The Petitioners say that R1 (and WPE) exercised the swamping rights before they were a last resort and, in any event, (in effect) engineered the insolvency which triggered the right to swamp.

P1’s exclusion

- On 23 August RH suspended P1 from the company pending “a review of the situation”. On 28 January 2020 P1 was invited to a disciplinary hearing to be chaired by John Roche supported by David James, an HR consultant. Ten allegations were listed, the most serious of which were that P1:

- Misappropriated company funds by using company money to pay a tax bill in March 2019 and to other pay personal expenses.

- Deliberately misled the board about his ability to fulfil his underwriting commitments and pay the due sum of £550,000 specifically by committing to pay £550,000 into Brabners’ client account on 20 August.

- Further details were provided. In respect of the use of company money, P1 had agreed (in the loan agreement) not to deal with his loan account or to seek any repayment of the sums he had lent save in accordance with the terms of the investment agreement. It appeared (and P1 accepts as a fact) that certain sums had been paid to him by the company and credited to his loan account:

- £25,000 on 5 February 2018 to repay a personal loan

- £2,065 on 1 March 2018 to pay an interior design company for personal work

- £1,500 on 2 May 2018 to pay part of a fine payable by P1 to Companies House

- £40 paid to Flannels for personal purchases

- £42.93 and £634.33 for council tax

- £70 and £100 for a parking fines

- £21,976.68 payment to HMRC in respect of personal tax on 29 March 2019

- £99.99 for a ukulele

- £1,000 accountants costs to complete tax returns

The Petition

- The amended Petition deals with the Offer at paragraphs 24 to 32. The Petitioners plead that the transfer of the sale shares was conditional on “the take up of” all the new shares and that the new shares were in fact “taken up”. The Petitioners’ case is that the failure to pay for the new shares was irrelevant. At paragraph 35 it is pleaded that at the meeting of 12 August Waterland “vetoed” completion of the new share and sale share transactions without giving any reason. At paragraph 37 the Petitioners’ case is that by 19 August 2019 the monies needed to complete the new shares purchase “had been obtained” (and, as pleaded at paragraph 47 of the Reply) therefore “raised”.

- At paragraph 56, summarising the unfair prejudice relied on, the Petitioners plead that:

- P1’s suspension was spurious and a device to perpetrate unfair prejudice and weaken P1’s position

- R1’s retraction of its offer to buy the sale shares was unfairly prejudicial, ill-motivated, “designed to engineer a situation of default for its own gain”, and self-serving as “a device to permit an injection of alternative funding and then claim rights to swamp”.

- The Petitioners’ reply pleads that the Respondents had a long established “collateral agenda” to obtain majority control of the company and scupper the potential to raise funds through the rights issue.

- The points of defence are summarised at paragraph 5 thereof. R1 avers that it was entitled to exercise its enhanced voting rights and so swamp and in doing so followed the Articles of Association and so acted in a manner signed up to by the Petitioners. At paragraph 40 the Respondents plead, by reference in particular to paragraph 3.10 of the offer letter, that the sale shares acquisition could only go ahead if the acquisition price of the new shares was paid. They plead:

"The condition is the raising of not less than £2,005,085.78 in total subscriptions through complete applications. Under the terms of the Offer Letter, applicants had to pay for their subscriptions in cleared funds by 16 May 2019. The Company would not raise the funds until it received such payment. Accordingly, the Sale Shares Offer was conditional on the Company receiving payment of at least £2,005,085.78." (emphasis in the original)

- At paragraph 48(d) the Respondents plead that this condition was never waived.

- At paragraph 71 the Respondents plead that

“The Insolvency Event was not created by Waterland (or Tagco). The Insolvency Event arose because Mr Durose failed to pay for his allocation of New Shares, despite his obligation to do so, and his repeated assurances which led the Company to believe up until the very last minute that he would pay. The Company was relying on that money coming in to pay its debts. Waterland’s refusal to allow the Sale Shares Offer to complete simultaneously with the Open Offer was within its contractual rights and a commercially necessary step to ensure that the Company received the maximum possible benefit from the funding Waterland was able to provide on an urgent basis. By the time Mr Durose finally admitted that he was not going to be able to pay for his allocation of New Shares, the Company was unable to pay its debts and had no alternative but to seek emergency funding from the Respondents.”

The proposed re-amendment

- The Petitioners seek permission to re-amend the amended Petition to rely on the email of 16 October 2017 (see paragraph 30 above). They seek to plead a case that the email gives rise to what would once have been called a “legitimate expectation” that the circumstances in which the swamping rights would be exercised would be curtailed. The full proposed re-amendment is as follows:

56.2 Further, as Mr Hallworth states at paragraph 20 of his witness statement, the swamping rights provision was the subject of particular attention at the time of the draft Investment Agreement such that, by email dated 16 October 2017, he sought specifically to reassure Mr Durose on behalf of the pre-existing members by stating, “To reiterate on the Swamping rights, this isn’t designed to take away shares. This is a matter of last resort that we can take over day-to-day decision making if the business is about to go under”. As Mr Dutton adds at paragraph 27 of his witness statement, there was no ambiguity about it, that email is “exactly how we all understood it”.

56.3 The Petitioners’ case at paragraphs 49 and 56.1 above is that Waterland’s use of the swamping rights provision was ill-motivated and self-serving come what may, but further or in the alternative, the above email itself creates equitable considerations in the determination of the Petition for unfair prejudice making it unjust or inequitable for Waterland to insist upon its contractual rights or exercise them in a way contrary to the reassurance because the email represented particular dealings creating a legitimate expectation that the provision would only be used in accordance with the express reassurance.

56.4 In the premises, Waterland acted inequitably causing the Petitioners to suffer unfair prejudice because, but for its own last-minute election to withdraw its participation in the back-to-back rights issue and share sale, the Company would have received c.£2m in liquid funds; thereby it was not otherwise actually about to ‘go under’ at all and the alleged ‘last-resort’ was only Waterland’s own self-serving creation.

56.5 For the avoidance of doubt, the Petitioners contend that they do not need to pursue separate causes of action herein in misrepresentation and/or promissory estoppel.

56.6 For the avoidance of doubt, the Petitioners contend that the terms of the December 2017 investment documents (including entire agreement clause) and revised Articles do not exclude equitable constraints. Notwithstanding that the email may not have founded a separately enforceable agreement in and of itself, nevertheless it was inequitable for Waterland to depart from it in the manner in which it did.

56.7 For the avoidance of doubt, the above is a matter relating to conduct of the affairs of the Company because the law requires a liberal application of that criterion and here it is not in dispute that the implementation of swamping and dilution by Waterland of all the other members required formal notice to the Company (voting adjustment), the urgent appointment of new directors, the issuing of new shares and the associated resolutions to be passed.

- I propose to grant permission for the amendment. In my judgment it can be dealt with swiftly and to refuse permission to allow this essentially legal argument to be advanced would not further the overriding objective.

- The parties have helpfully agreed a list of issues for me to determine. Before turning to the issues, I will set out the relevant law.

The law

- Section 994 of the Companies Act 1996 allows a member of a company to apply to the court by petition for an order under Part 30 of the Act on the ground that the company’s affairs are being or have been conducted in a manner that is unfairly prejudicial to the interests of members generally or of some part of its members (including at least himself).

- Section 996 of the Act allows the company to grant relief should it be satisfied that the petition, and the allegations of “unfairly prejudicial conduct” it contains, is “well-founded”.

- There was little dispute between the parties as to the law. It is agreed that the House of Lords decision in O’Neill v Phillips [1999] 1 WLR 1092 is the correct starting point. Lord Hoffmann (referring back to his decision in Re Saul D Harrison & Sons [1994] BCC 475 where he had described the “unfairly prejudicial” test as “deliberately imprecise”) noted that the test was chosen by Parliament to free the courts from “technical consideration of legal right and to confer a wide power to do what appeared just and equitable”. The freedom so given is not absolute. Lord Hoffmann noted that the concept of “fairness” depends on context and that context in a company situation required consideration of the terms on which members of the company had agreed to deal with each other.

- Rules agreed by shareholders about how a company is to conduct its affairs are an especially important aspect of the background against which conduct is to be examined. Such rules always include the Articles of Association of a company and in the present case, include the “collateral agreements” entered into by the shareholders on 15 December 2017.

- In Re Coroin Limited [2012] EWHC 2343, citing Lord Wilberforce at p.380 in Ebrahimi v Westbourne Galleries Limited [1973] AC 360 David Richards J (as he then was) noted that the exercise of rights conferred by these legal rules (including those derived from the general law of companies) would (“in very many cases”) be “unexceptionable and part of the risk that a [member] of a company accepts”. Generally speaking, conduct that is within the rules should not be considered as “unfairly prejudicial”. As Lord Hoffmann put it in O’Neill: “a member of a company will not ordinarily be entitled to complain of unfairness unless there has been some breach of the terms on which he agreed that the affairs of the company should be conducted.”

- But a “technical consideration of legal right” is not enough. In some (limited) circumstances, equity will intervene to prevent (or temper) the exercise of strict legal rights if the relationship between the parties is such that strict adherence to those legal rights would be contrary to good faith.

- The starting point therefore (bearing in mind that not every breach of the Articles or “rules” will be capable of amounting to unfair prejudice) is to ask if the conduct complained of was in accordance with the “rules” which govern the conduct of the company. If so, the next question is whether in the particular circumstances of the case, equitable considerations that mean that strict legal rights cannot be relied on. Such equitable considerations would give rise to a “legitimate expectation” which the court would uphold, that the strict rights would not be insisted upon.

- In Re Coroin [2012] EWHC 2343 (Ch), David Richards J (as he then was) emphasised that it was necessary to establish that the matters complained about arise out of the conduct of the affairs of the company, but accepted that the court should not adopt “a technical or legalistic approach” to what constitutes the affairs of the company but will look to business realities (see also paragraph 309 of VB Football Assets referred to below). He accepted that the affairs of the company would encompass all matters which may come before its board or are capable of coming before the board (see Neath Rugby (no.2) [2009] 2 BCLC 427) and all matters which must go to the company in general meeting for consideration.

- David Richards J (as he then was) went on to deal with the argument that equitable considerations had arisen in that case. He expressed the view that such considerations would only arise in cases where there are “considerations of a personal character between the shareholders which makes it unjust or inequitable to insist on legal rights or to exercise them in a particular way. Typically, will be in the case of a company formed by a small number of individuals on the basis of participation by all or some of them in the management of the company.” The Learned Judge found there was no room for such considerations in that case because: