|

|

Notice of the making of this Statutory Instrument was published in

|

|

|

“Iris Oifigiúil” of 31st March, 2015.

|

|

|

In the exercise of the powers conferred on it by Section 32E of the Central Bank Act 1942 (as inserted by the Central Bank Reform Act 2010 ), the Central Bank Commission hereby makes the following regulations, which shall be effective upon the approval of the Minister for Finance:

|

|

|

1. These Regulations may be cited as the Central Bank Act 1942 (Section 32E) Prospectus and Related Documents Approval Fee Regulations 2015.

|

|

|

2. These Regulations shall come into operation on 1 May 2015.

|

|

|

3. In these Regulations, except where the context otherwise requires:

|

|

|

“approval of a Relevant Document” means the positive act at the outcome of the scrutiny of the completeness of a Relevant Document by the Bank including the consistency of the information given and its comprehensibility;

|

|

|

“Bank” means the Central Bank of Ireland;

|

|

|

“enactment” means the Prospectus (Directive 2003/71/EC) Regulations 2005 ( S.I. No. 324 of 2005 );

|

|

|

“fee notice” means a notice in writing sent by the Bank indicating the required fee amount payable in respect of the approval of a Relevant Document submitted in accordance with Regulation 5;

|

|

|

“Prospectus Rules” means the rules and guidance relating to the application of such rules issued by the Bank under section 51 of the Investment Funds, Companies and Miscellaneous Provisions Act 2005 that shall apply to Relevant Documents;

|

|

|

“Relevant Document” means any document submitted to the Bank for approval under the enactment or the Prospectus Rules, and shall include those documents referred to in the Schedule;

|

|

|

“Relevant Person” means an issuer, offeror or person seeking admission to trading, as the case may be, that submits a Relevant Document, either directly or through an agent;

|

|

|

“Schedule” means the Schedule to these Regulations.

|

|

|

In these Regulations, except where the context otherwise requires, words and expressions that are also used in the enactment have the same meaning as in the enactment.

|

|

|

4. In accordance with the provisions of Section 32E of the Central Bank Act 1942 , each Relevant Person that submits a Relevant Document shall pay to the Bank a fee in respect of the approval of a Relevant Document (“required fee amount”) the amount of which is specified in the Schedule opposite to the applicable category or categories of securities.

|

|

|

5. The Bank may issue to a Relevant Person (or to a Relevant Person’s agent in circumstances where such Relevant Person has submitted a Relevant Document through an agent) a fee notice.

|

|

|

6. The Bank shall determine the appropriate category in the Schedule that shall apply to a Relevant Document submitted in accordance with Regulation 4.

|

|

|

7. The required fee amount shall be payable to the Bank prior to approval by the Bank of the Relevant Document in question.

|

|

|

8. The required fee amount shall be paid by direct bank transfer or equivalent electronic transfer of funds to the bank account specified by the Bank, or in such other manner as is specified by the Bank.

|

|

|

9. The Bank may reduce, remit or waive a required fee amount, or extend the time for payment (as set out in Regulation 7 hereof) of all or part of a required fee amount in exceptional circumstances (at the Bank’s discretion), upon the request of a Relevant Person.

|

|

|

10. Every sum payable by a Relevant Person under these Regulations shall be recoverable by the Bank from that Relevant Person as a simple contract debt in a court of competent jurisdiction.

|

|

|

11. A fee notice issued in accordance with these Regulations to be served on a Relevant Person (or to a Relevant Person’s agent in circumstances where such Relevant Person has submitted a Relevant Document through an agent) by the Bank may be served:

|

|

|

(a) if the Relevant Person (or agent if applicable) is an individual-

|

|

|

(i) by delivering it to that person, or

|

|

|

(ii) by sending it by post addressed to that person at the persons usual or last known place of residence or business, or

|

|

|

(iii) by leaving it for that person at that place.

|

|

|

(b) if the Relevant Person (or agent if applicable) is a body corporate or an unincorporated body of persons, by sending it to the body by post to, or addressing it to and leaving it at, in the case of a company, its registered office (within the meaning of the Companies Act 2014 ) and, in any other case, its principal place of business.

|

|

|

(c) in all cases, by facsimile by transmitting it to that persons last known facsimile number evidenced by a valid sent receipt or, with the agreement of both parties, by electronic communication to an address specified by that person.

|

|

|

12. The Bank may exercise any of the powers and perform any of the functions and duties imposed on the Bank by these Regulations through or by any of the officers or employees of the Bank.

|

|

|

13. The Central Bank Act 1942 (Section 32E) Prospectus and Related Documents Approval Fee Regulations 2011 ( S.I. No. 632 of 2011 ) are revoked, such revocation having been approved by the Minister for Finance.

|

|

|

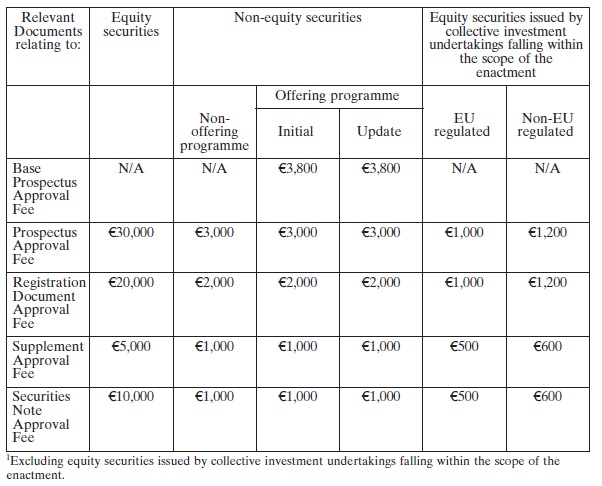

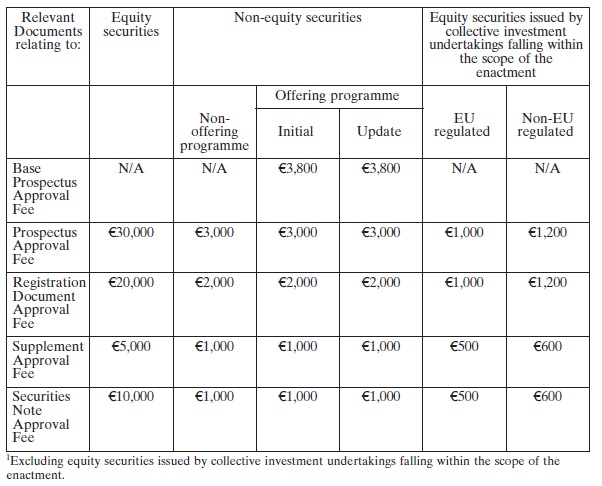

SCHEDULE

|

|

|

RELEVANT DOCUMENT FEES

|

|

|

In this Schedule, words and expressions that are also used in the enactment have the same meaning as in the enactment.

|

|

|

The following fees will apply in respect of the submission of a Relevant Document in accordance with these Regulations:

|

|

|

|

|

|

|

|

|

Signed for and on behalf of the CENTRAL BANK COMMISSION

|

|

|

26 March 2015.

|

|

|

CYRIL ROUX,

|

|

|

Deputy Governor (Financial Regulation).

|

|

|

EXPLANATORY NOTE

|

|

|

(This note is not part of the Instrument and does not purport to be a legal interpretation.)

|

|

|

These Regulations, made by the Central Bank Commission, revoke and replace the Central Bank Act 1942 (Section 32E) Prospectus and Related Documents Approval Fee Regulations 2011 ( S.I. No. 632 of 2011 ) in accordance with section 32E of the Central Bank Act 1942 . They set out the obligation on applicants for prospectus approval to pay a fee in advance of receipt of that approval. Updated Regulations will be published from time to time by the Central Bank of Ireland on its website and in other ways that the Deputy Governor (Financial Regulation) deems appropriate.

|

View PDF

View PDF